Introducing Cedar’s Affordability Navigator: Connect patients with Medicaid enrollment, outside funds and self-service tools so they can affordably pursue the care they need.

Between 2020 and 2022, 31-year-old Jeremy of Denver, Colorado was in and out of the emergency department without insurance. He racked up more medical bills than he could afford, landing about $4,200 in debt.

The experience has since kept him away from needed care. “There are definitely some medical visits that I really should do but I just avoid them because I know the consequences of not having insurance,” he said.

Jeremy’s story is far from unique. A 2022 Kaiser Family Foundation poll found that 100 million Americans—a shocking 41% of adults—are saddled with medical bills they cannot pay. What’s more, 43% have either skipped or postponed needed care due to cost.

These challenges are not new for patients or healthcare leaders. But with the unwinding of the COVID-19 public health emergency, the situation is now getting worse.

Healthcare’s looming coverage crisis

As of November 2023, more than 10 million people have been removed from the Medicaid rolls since pandemic-era protections ended, mainly for procedural reasons. This should keep every hospital CEO, finance executive and senior physician awake at night. Why?

During periods of uninsurance, patients tend to forgo routine and preventative care as well as services for major health conditions and chronic diseases, which can lead to long-term poor health outcomes. When they do seek care—often through the emergency department—they can become saddled with big bills that they may not be able to pay. According to Cedar’s 2024 Healthcare Financial Experience Study, this too, can be bad for patients’ health.

An uptick in the uninsured rate is also likely to impact providers’ bottom lines. Our analysis of 2022 data from five health systems revealed that 62% of patient balances captured comes from just 16% of patients, specifically those with balances greater than $1,000. These individuals are 2.1x more likely to have a bill in collections, with many winding up in bad debt. It’s clear that even a slight shift in payer mix can have a material impact on a provider’s financial performance.

Affordability Navigator is here to help

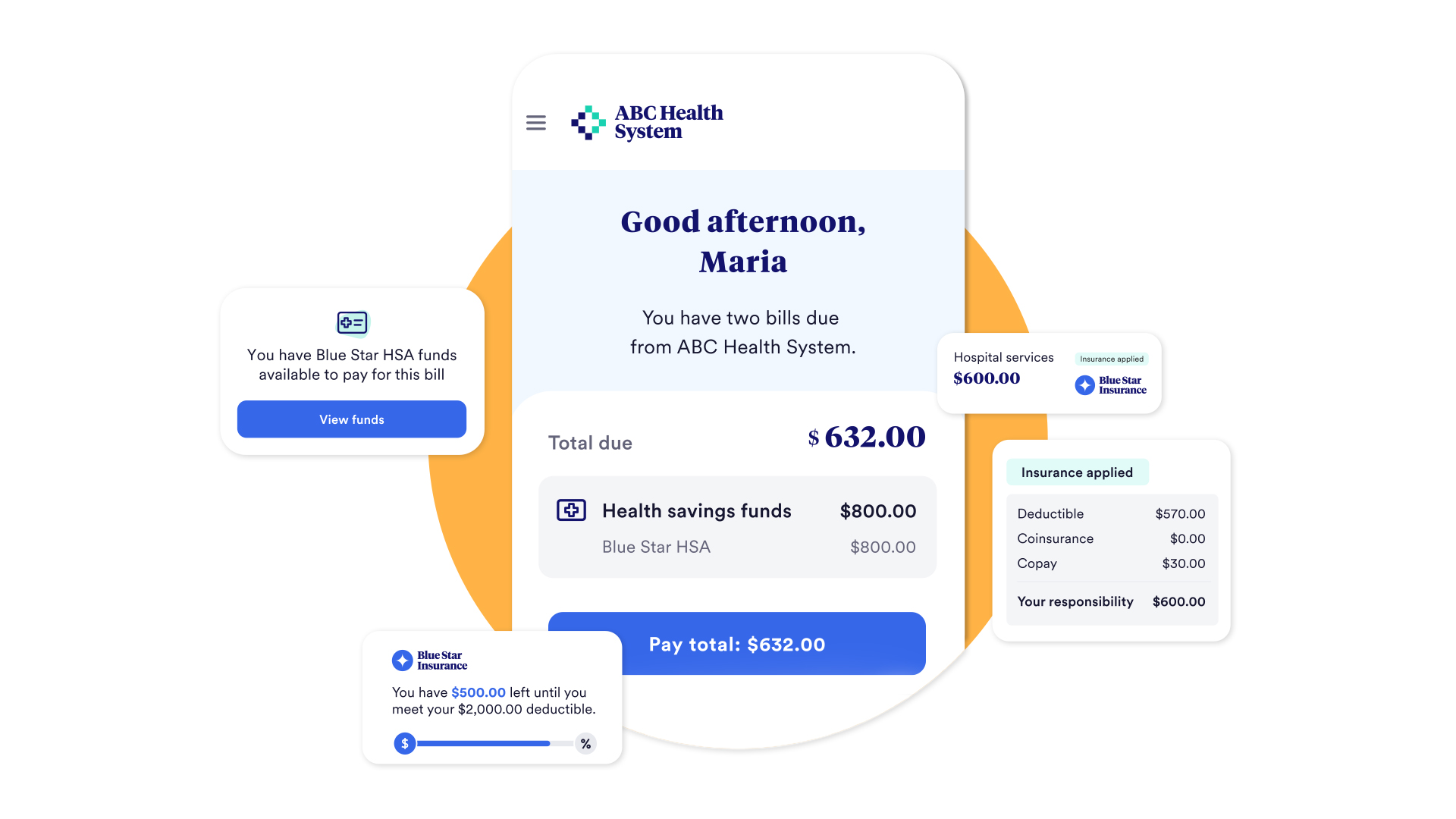

Affordability Navigator is an integrated set of financial assistance capabilities that empower patients to unlock hidden dollars for their care. A breakthrough feature of this release is full-service Medicaid enrollment, which we developed in partnership with Advocatia, a leading benefits and financial assistance enrollment solution for providers.

Now, patients can use digital tools to self-enroll in Medicaid. Through proactive screening and targeted outreach, we enable Medicaid enrollment for eligible patients at opportune moments. When patients begin their personalized application process, we offer empathetic guidance at every step, including human support, to help eligible people stay motivated and on a path to coverage.

When more eligible patients are empowered to apply for Medicaid, providers can improve their financial performance. Affordability Navigator can also lighten the load on financial counseling teams, enabling providers to efficiently service and enroll a higher volume of eligible patients. Most importantly, more patients can affordably pursue the care they need. With access to high-quality and free or low-cost coverage, patients are likely to actively engage in their care without fear of debt.

What’s next

Healthcare’s affordability problem may seem like a financial issue, but in reality, it’s also a matter of public health. This makes addressing it a strategic imperative—and ethical responsibility—for providers whose missions are to promote health and well-being in the communities they serve.

We’re proud of our work with Advocatia to extend insurance coverage to millions of Americans and remain committed to further progress. Numerous resources are available to assist patients in affording their care, including charity care, medication assistance and philanthropic aid, among others. Our vision is to connect each patient with the personalized financial assistance they may need to resolve their bills, helping to create a more accessible and equitable healthcare system.

See how healthcare organizations like AnMed are protecting their patients’ access to care and their own bottom lines, with Cedar’s Affordability Navigator.

Joanna Jamar is Senior Director, Commercial Strategy at Cedar