Cedar surveyed 1,200 consumers and it’s clear they want to pay their healthcare debts. But their bills are unaffordable, the process is needlessly complicated and the whole ordeal is bad for their health. Get your free copy of the 2024 Healthcare Financial Experience Study.

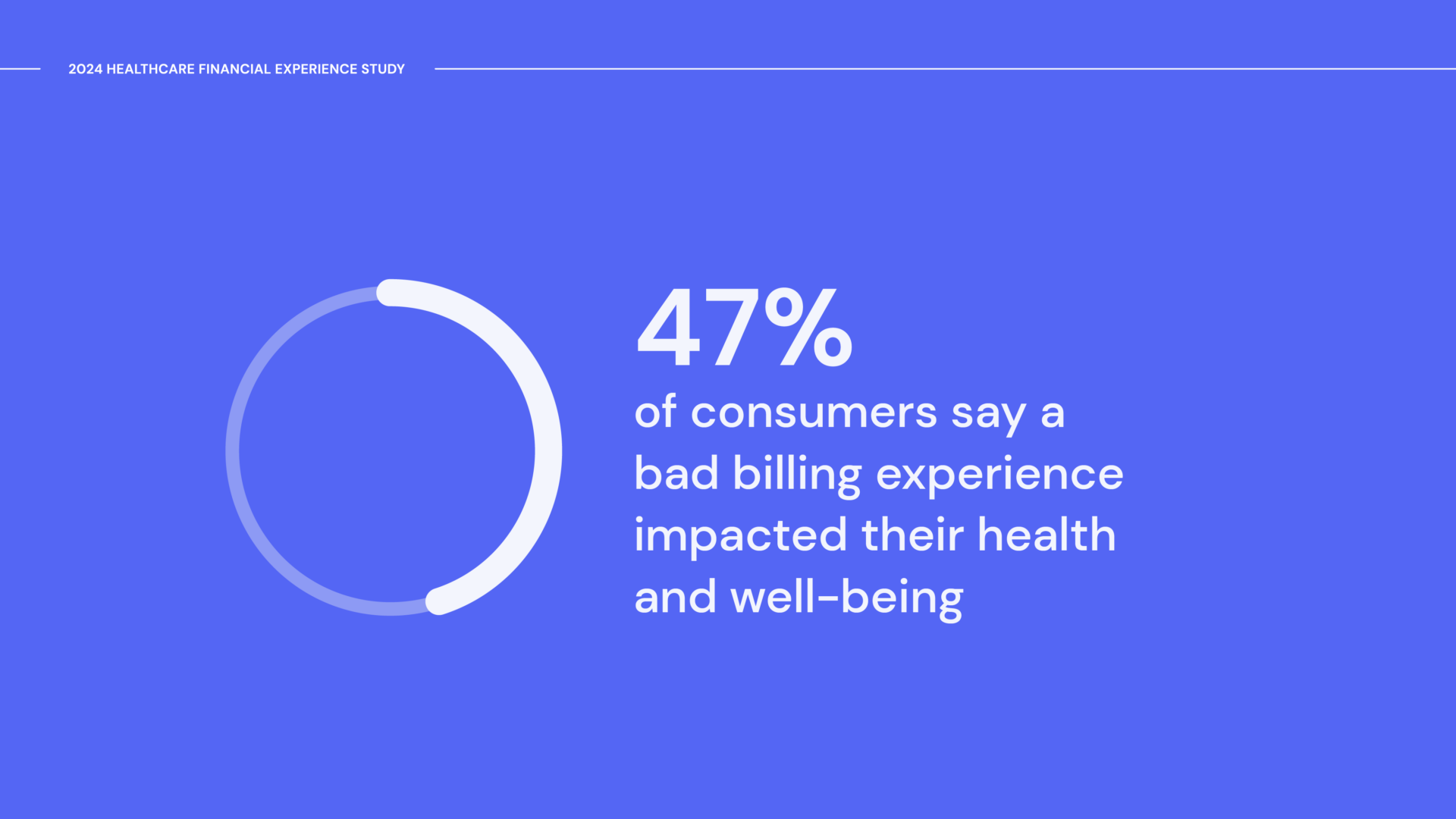

Cedar’s 2024 Healthcare Financial Experience Study revealed a disturbing trend: about half of consumers say their healing or well-being has been negatively impacted by difficulty paying a medical bill.

This is a huge problem. In fact, it may be the biggest problem that providers face when it comes to the healthcare financial experience. Promoting health and well-being is the mission of most leading healthcare institutions, which makes addressing the patient billing problem a strategic imperative in 2024.

Let’s dig deeper into the data to understand how dysfunctional billing affects consumer health. For the full study results, get your free copy here.

Stressed and caught between providers and payers

One of the fundamental problems with medical bills is they arrive at the worst possible time: when consumers are vulnerable and recovering from care. If the payment process is too complicated, insurance benefits aren’t clear or the bill is unaffordable, it compounds the stress that consumers may already have about their health.

We learned that nearly three in five consumers find paying for care stressful. It was even more pronounced for individuals with balances higher than $1,000, who are more likely to be managing complex conditions and at risk for health complications.

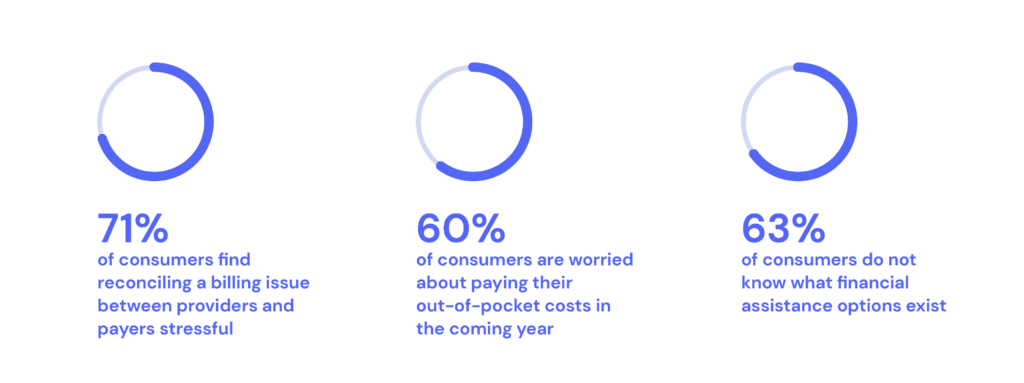

Notably, payer-provider coordination on patient billing stood out as an opportunity for improvement. A whopping 71% of consumers find reconciling billing issues between providers and payers stressful and three-quarters wish they could view real-time insurance benefits when looking at bills.

“We have to get providers and payers working together better,” said James Rohrbaugh, Chief Financial Officer at Allegheny Health Network. “It’s not fair to the consumer to be in the middle of this—at their most vulnerable moment.”

Read about how Allegheny Health Network and Highmark are working together to give consumers a single source of billing truth, with Cedar’s Payer Intelligence Layer.

Keeping the sick away from care

The impact of the patient billing problem on health could also stem from consumers not receiving needed care.

“A lot of times we find that patients just won’t go to the appointment rather than tell their doctor [about financial challenges],” explained Caitlin Donovan, Senior Director at the Patient Advocate Foundation.

A 2022 Kaiser Family Foundation survey found that 43% of consumers put off care because of cost. Providers should expect this trend to continue in 2024, as we uncovered that nearly 60% of consumers are worried about paying their out-of-pocket costs in the coming year. Sadly and ironically, skipping out on care likely leads to more medical bills down the line.

Other consumers may not have had a choice in the matter. According to the Kaiser Family Foundation, one in seven consumers were denied access to a healthcare provider due to unpaid bills, a controversial practice that’s increasingly under public scrutiny.

While most providers make meaningful investments in people and programs to support underserved populations, some consumers still fall through the cracks. This gap was borne out by our data: about a quarter of consumers can’t afford a medical bill greater than $250, yet 63% are in the dark about what financial assistance options exist.

“We encourage patients to talk to their doctors about financial stress, because there are things doctors can do. Your finances and health are so intimately intertwined—that has to be a conversation,” said Donovan.

Financial health is health

The 2024 Healthcare Financial Experience Study offers an important lesson: financial health is inextricably linked to overall health. If providers don’t take care of billing, they can’t fully take care of patients. Alleviating financial stress, bridging the payer-provider divide and scaling financial aid are clear opportunities for providers to safeguard both the financial and physical well-being of consumers.

See more insights. Download the study to learn what’s stopping consumers from applying to financial aid, why consumers aren’t using money in their HSAs and more.

Ben Kraus is a Content Strategy Manager at Cedar