This is the first in a three-part blog series covering some of the main trends in Cedar’s 2021 Healthcare Consumer Experience Study. To read the full study, click here.

On Jan. 1, 2022, a landmark piece of patient billing legislation will go into effect: the No Surprises Act.

The law aims to protect patients from surprise healthcare bills so they’re only responsible for in-network costs. The Congressional Budget Office estimated the policy would lower health insurance premiums 1% and decrease the federal deficit by approximately $17 billion. Meeting consumer demand and decreasing the deficit? Sounds great!

However, for it to gain traction in the real world, providers and payers have to proactively work together. The need for provider-payer collaboration was a common theme in Cedar’s 2021 Healthcare Consumer Experience Study. Here’s what over 1,500 U.S. adults had to say about the need for better billing practices.

Finding a source of truth

Given the seamless digital experiences offered by retail, finance etc., it seems reasonable to ask why healthcare still presents indecipherable bills, broken communication, inaccurately tallied out-of-pocket costs and out-of-date payment options.

According to Mac Boyter, research director at healthcare consultancy KLAS Research, much of it comes down to the “Balkanized” nature of American healthcare, devoid of a “single source of truth.”

“It creates huge amounts of confusion and churn that then gets passed on to the patient,” Boyter says. “What’s really tough about this is that these are human beings that are already in a vulnerable place who now have the onerous task of figuring out how to pay their bills.”

The lack of a “single source of truth” is unsurprisingly immensely stressful for most healthcare consumers. More than half (55%) of those in our survey find it stressful paying a healthcare bill, understanding their plan’s coverage and benefits (53%) or comprehending what they owe (53%). And 59% find it stressful reconciling a bill issue with their payer. At the same time nearly half of respondents would like to see changes and clarity around which services are authorized by their health plan before making an appointment. The same proportion wants increased transparency around expected out-of-pocket costs before scheduling an appointment.

This dissatisfaction is compounded given the lack of dialogue between payers and providers. Roughly one-third (31%) of respondents are not satisfied with the coordination between their healthcare provider and payer. Consumers often communicate separately with their physicians and payers. Yet their providers and payers rarely talk with one another about a consumer’s plan of care. This lack of alignment, combined with the fragmented nature of healthcare, leaves consumers sometimes feeling helpless. They’re stuck in the middle between two powerful entities unwilling to communicate.

Billing lags behind in the healthcare journey

One of 2020’s main developments was the rise of telehealth that improved the patient experience during the biggest public health emergency in generations. Nearly 60% of survey respondents say their healthcare provider has introduced new technology that facilitates social distancing (e.g., touchless paperwork, no waiting room, telemedicine) as result of the COVID-19 pandemic.

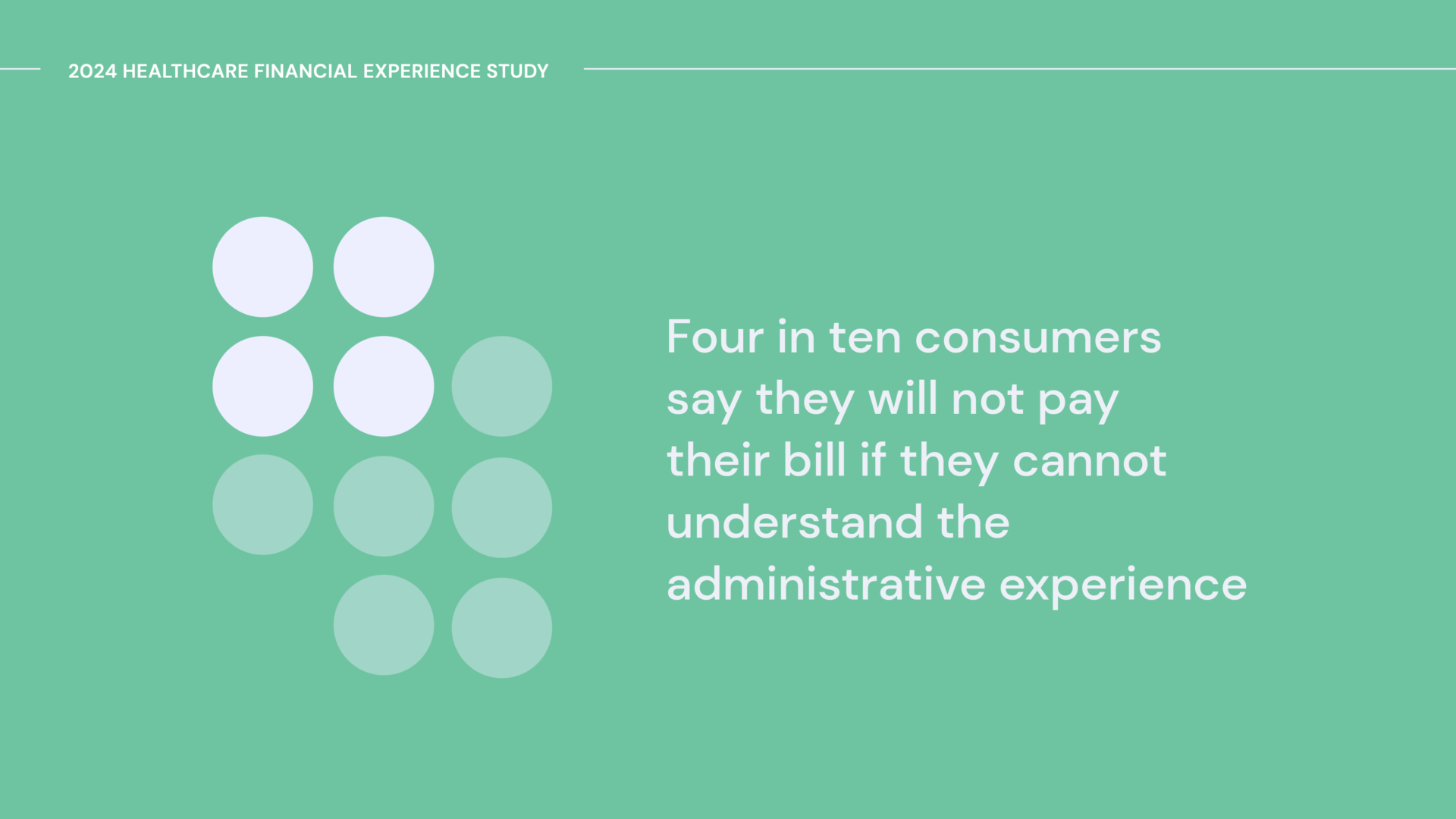

Consumers appreciate these technological strides to ensure safe and touchless experiences; three-quarters of survey respondents are satisfied with the overall interactions they have with healthcare providers and staff. The bad news is that when looking specifically at the financial experience, 40% are dissatisfied with billing. In dealing with payers, nearly 40% report that when inquiring about a bill, they are dissatisfied with insurance provider interactions.

To compound matters, 93% of consumers say the quality of the billing and payment experience is at least somewhat important to their decision to return to a healthcare provider in the future; 96% report it also contributes to their overall satisfaction with their payer.

The stakes are no doubt high for payers and providers. But there’s ample opportunity to elevate the consumer experience with digital billing and communication tools that deepen loyalty and generate repeat business.

This is an excerpt from the 2021 Healthcare Consumer Experience Study. Click here to access the full report now.