Cedar surveyed 1,200 consumers and it’s clear they want to pay their healthcare debts. But their bills are unaffordable, the process is needlessly complicated and the whole ordeal is bad for their health. Get your free copy of the 2024 Healthcare Financial Experience Study.

Simpler statements, multi-channel billing, self-serve payment plans—providers have done their best to improve the healthcare financial experience. But most have yet to give consumers what they really want: a single source of truth across providers and payers.

According to Cedar’s 2024 Healthcare Financial Experience Study, 73% of consumers wish they could view real-time benefit information when looking at bills. They’re tired of sifting through the disconnected statements and explanations of benefits (EOBs) piling up in their mailboxes, struggling to make sense of what they owe and why.

While this certainly isn’t providers’ fault, it comes at their expense. Our study also revealed that payer-provider misalignment seriously impacts patient payments and loyalty. Keep reading to understand the true cost of confusing bills, uncoordinated EOBs and fragmented communications, and for a deeper look at the study results, head here.

Consumers won’t pay what they can’t understand

Cedar’s user research found that most consumers want answers to two big questions when paying healthcare bills:

- Did my insurance cover the right amount?

- Am I responsible for the right amount?

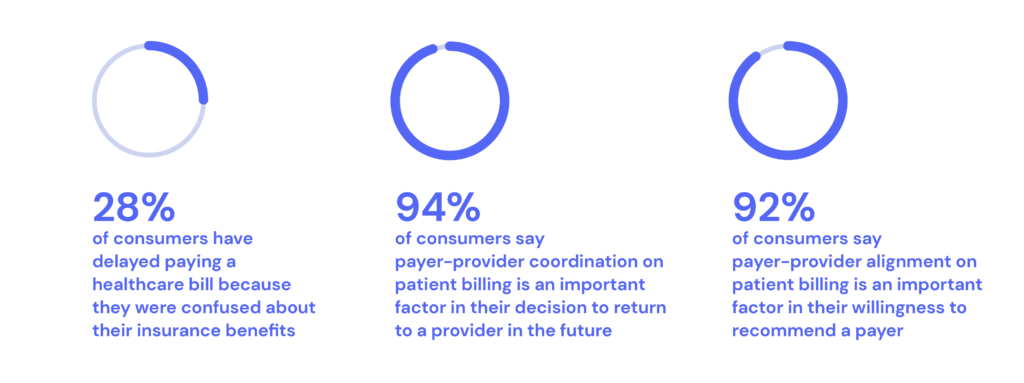

It’s not surprising, then, that 28% of consumers have delayed paying a bill because they were confused about their insurance benefits. “The biggest frustration is when patients feel like they are being forced to make decisions without all the facts,” explained Vincent Tammaro, Chief Financial Officer at the Ohio State University Wexner Medical Center.

Many consumers won’t make a payment until they feel confident that their insurance benefits have been correctly applied and often wait for separate payer EOBs. As a result, providers wind up having to send out more statements and make outbound calls while handling inquiries about insurance coverage, all of which drive up the cost to collect.

Our research also found that four in ten consumers simply won’t pay if they don’t understand the administrative experience. This alone should motivate providers to take ownership of the various touch points that inevitably happen when consumers leave the hospital, including those with payers.

“It shouldn’t be the provider’s responsibility to do that, but patients connect with us—the people who see them and take care of them—much more than with the insurer, who is just a card in their pocket,” said Tammaro.

Payer-provider alignment profoundly impacts loyalty

The study data also showed that a lack of payer-provider coordination on patient billing has revenue implications. Nearly every consumer (94%) said that it’s highly influential in their decision to return to a provider in the future. About the same share (92%) said it’s important to their likeliness to recommend a provider.

These findings are especially significant considering the competition providers face today. Not only are they up against providers two highway exits—or subway stops—away but also consumer-native retailers and non-acute platforms with deep pockets. These organizations are focused on attracting the most commercially accretive consumers, which puts a finer point on bringing payers into the patient billing process.

“We have to get providers and payers working together better,” said James Rohrbaugh, Chief Financial Officer at Allegheny Health Network. “It’s not fair to the consumer to be in the middle of this—at their most vulnerable moment.”

Now providers may be wondering: what’s in it for payers? Our study found that payers are as likely to get implicated for a fragmented financial experience. When it’s difficult for consumers to understand their bills in the context of their insurance benefits, it drags down payer net promoter scores and chips away at member loyalty.

Everyone wins when providers and payers work together

While payer-provider misalignment on patient billing is the norm across the industry, it’s clear the high cost of confusion is too high to ignore. Cedar has proven that when providers and payers collaborate for the benefit of consumers, it leads to a better experience and outcomes for everyone. Just ask Allegheny Health Network, who added more than $17 million in patient payments in less than one year and achieved 90% customer satisfaction after integrating payer Highmark into their patient billing using Cedar Pay.

See more insights. Download the 2024 Healthcare Financial Experience Study to learn what specific payer information consumers need to pay faster, why consumers aren’t using funds in their health savings account and more.

Ben Kraus is a Content Strategy Manager at Cedar