Get the full analysis to see which patients provider financial assistance programs might be missing and actionable strategies for revenue cycle teams to support.

It might surprise some healthcare leaders to learn that 35% of patient responsibility across our health system partners comes from bills without insurance coverage.1 You’d think it would be lower, considering self-pay patients are usually just a small slice of a provider’s population—and the uninsured rate is at historic lows.

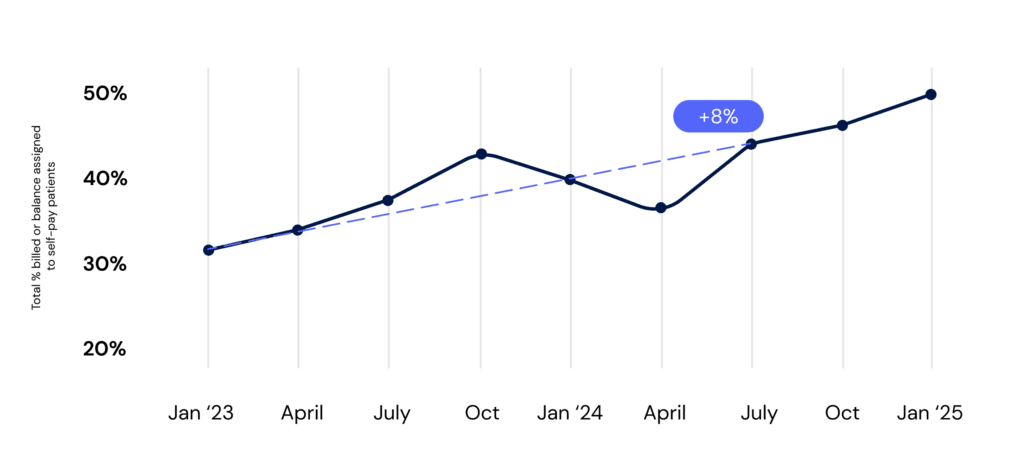

But that number is creeping up, and it’s hard to ignore. It grew 8% year-over-year,2 signaling a shift toward self-pay, where providers might recover as little as ten cents on the dollar. Every dollar lost here adds pressure to patient balance after insurance collections, making cash flow harder to sustain.

On top of that, uninsured patients need completely different engagement strategies—ones that most financial counseling programs are just not built to handle at scale. And given broader economic and policy headwinds, the strain on both patients and providers could only grow.

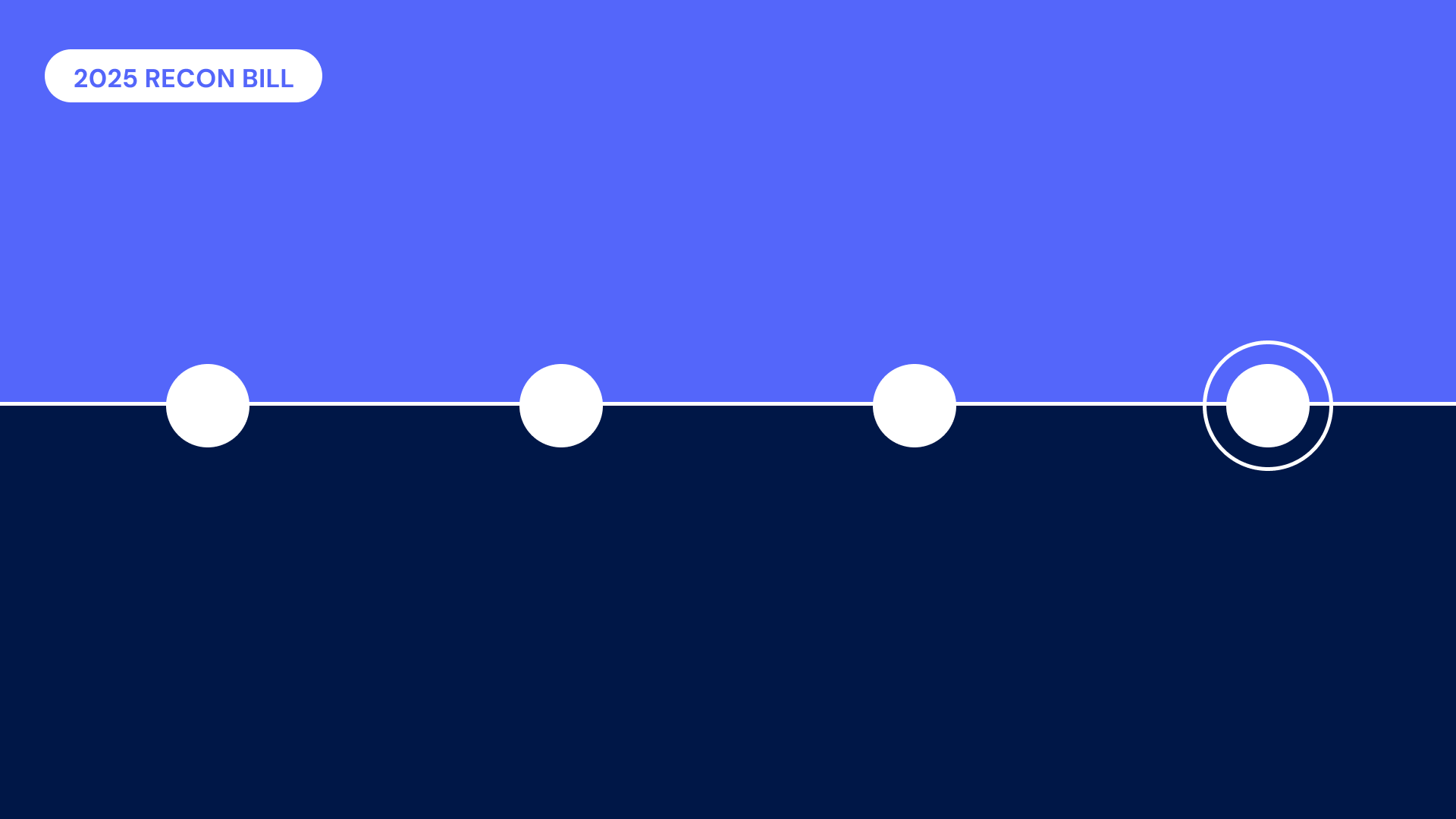

Patient responsibility without insurance coverage across Cedar health system partners: Jan 2023 – Jan 2025

What’s driving the shift to self-pay?

One major factor: Medicaid disenrollments.

In the past two years, more than 25 million people lost their Medicaid coverage when pandemic-era continuous enrollment protections ended, the full impact hitting in 2024. While some picked up marketplace plans with enhanced federal subsidies (more on those in a minute), many fell into coverage gaps—and still needed care.

Then there’s inflation. Growth in healthcare costs has historically outpaced the rest of the economy, but in 2021, that trend flipped. As broader inflation cooled in 2024, medical prices accelerated. In June 2024, those costs rose 3.3% year-over-year, surpassing the overall 3.0% consumer price increase. Hospital services saw an even sharper increase at 6.9%. While these growing costs ultimately burden all patients, the uninsured often feel it most acutely, with little cushion (i.e., insurance allowables) to soften the blow.

How these macro forces play out varies by region, as you’d expect. In Washington state, for example, our data shows a 14% drop in uninsured patients,3 but self-pay billings climbed by the same amount.4 In Texas, self-pay patients shot up 19%, while balances increased by 7%. Despite these local differences, the bigger trend is undeniable: self-pay is making up a larger share of patient responsibility, and the financial stakes for providers are rising.

Why this matters for providers

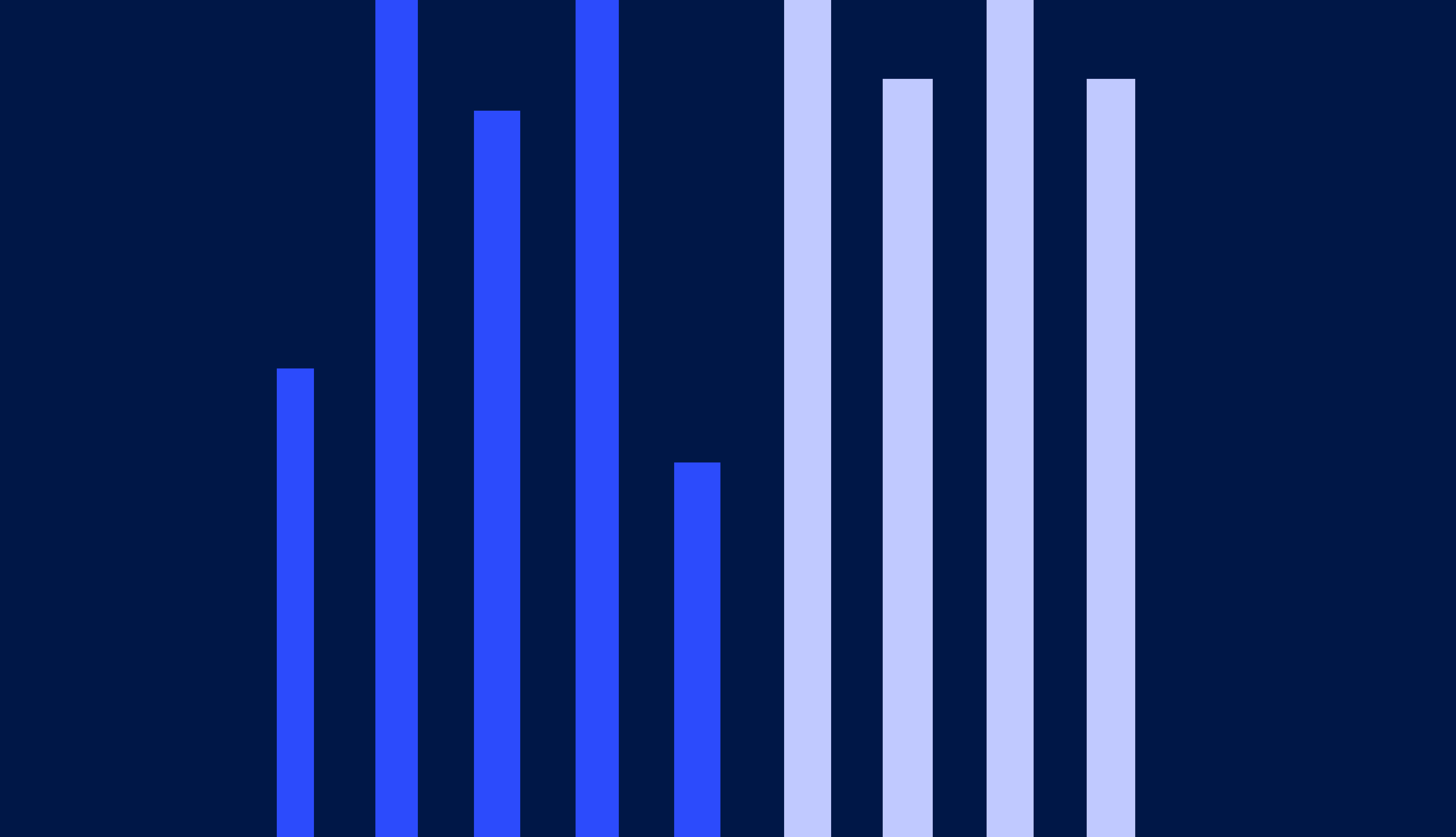

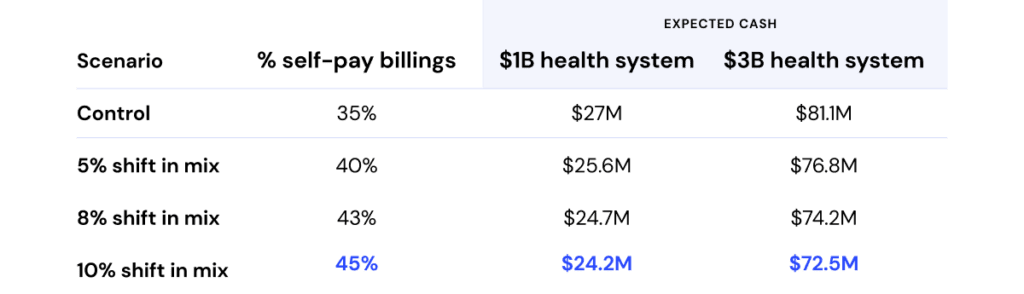

To put this into perspective, we used our 2024 PFX Benchmarks to analyze how a sustained shift toward uninsured patients impacts cash. Here’s what that looks like for a mid-sized and large health system:

Potential cash impact of rising self-pay bills

Numbers are illustrative.

Control scenario represents the average percentage of self-pay billings (35%) across a sampling of Cedar partners.

Patient responsibility is assumed to be 10% of annual net patient revenue.

Expected cash calculated using 2024 Cedar PFX Benchmarks median collection rate for balance after insurance patients (37%)5 and Cedar client average collection rate for self-pay patients (8.5%).6

In either case the impact is significant: a 10% shift in self-pay billings represents more than a month of lost patient collections. For a $3 billion system, that’s equivalent to the cost of a new ambulatory surgery center to expand surgical capacity. For a billion-dollar system, it could fund multiple new primary care locations to grow market share.

And this model only accounts for a mix shift. Factor in medical inflation and operational changes, and the impact could be even more pronounced.

But that’s only part of the story. Research from the Commonwealth Fund shows that 59% of surveyed uninsured people in 2024 skipped doctor visits when they needed care. Even more troubling, nearly half reported their condition worsened as a result. In an industry dedicated to healing, this should stop every hospital CFO, insurance executive, and senior physician in their tracks. If nothing else, it’s a flashing red light urging healthcare leaders to take action—especially as pending policy changes threaten to drive the uninsured rate even higher.

Policy headwinds to watch

One issue we’re tracking closely is the future of enhanced federal subsidies for ACA marketplace plans. These subsidies have been a financial lifeline for millions, helping lower premiums and out-of-pocket costs for those who don’t qualify for Medicaid but still struggle to afford coverage. But unless Congress steps in, they’ll expire at the end of 2025.

If that happens, premiums are expected to surge—by as much as 75%—forcing many people to stretch their budgets even thinner or join the ranks of the uninsured. The Congressional Budget Office estimates that 3.8 million Americans on average could lose their coverage each year between 2026 and 2034, putting them one medical emergency away from financial hardship.

At the same time, Medicaid funding remains an open question. While political rhetoric promises to protect the program, policymakers are exploring potential cuts, including changes to expansion funding and new work requirements. Such changes could significantly impact coverage for many of the 79 million Americans who rely on the program, adding more strain to an already overburdened system.

When you combine these potential policy changes with the proposed rule to ban all medical debt from credit reports, the growing self-pay risk becomes even more urgent. Without the hospital billing office’s biggest stick, providers will need better carrots—especially those that can materially reduce patient out-of-pocket costs and make care more affordable.

The bottom line

Self-pay is growing, and quietly shuffling unpaid bills to uncompensated care is no longer a viable strategy. That leaves providers with three options to help patients meet their obligations:

- Reduce billed amounts through adjustments and discounts

- Provide payment flexibility through payment plans

- Help patients navigate to third-party resources like Medicaid, ACA marketplace plans, and medication assistance

If affordability comes down to balancing patient costs against provider revenue, then the third option is particularly powerful: it brings new dollars to the equation. While financial counselors do great work connecting patients to coverage in high-touch settings like the emergency department, their reach is limited. Meanwhile, billions in assistance go unused each year—scattered across fragmented systems, disconnected from the patient experience, and nowhere to be found in the EHR patient portal.

But the real challenge? These resources are impossibly hard to navigate (if patients even know they exist), and the growing need outpaces what manual solutions can handle alone. Instead of relying solely on in-person programs or burying Financial Assistance Policies in the fine print of bills, providers need digital tools that can proactively match patients with sponsorship before they fall into bad debt.

We’ve made progress—insurance coverage is a sea change from what it was before the ACA. But 25 million uninsured Americans are still too many. Helping patients find coverage is one of those rare opportunities in healthcare: a break from the zero-sum game where mission and margin truly align.

Ben Kraus is Director, Content Marketing

- Average self-pay patient responsibility as a percentage of total patient responsibility in H1 2024 across a sampling of Cedar health system clients. ↩︎

- Growth in average self-pay patient responsibility as a percentage of total patient responsibility, H1 2023 vs H1 2024, across a sampling of Cedar health system clients. ↩︎

- Change in self-pay billed amounts broken out by state between 2023 and 2024 across a sampling of Cedar clients. ↩︎

- Change in self-pay patients broken out by state between 2023 and 2024 across a sampling Cedar clients. ↩︎

- Based on Cedar 2024 PFX Benchmarks for post-visit patient collection rate across all Cedar health system clients. ↩︎

- Mature 90-day collection rate January-August 2024 for self-pay patients across a sampling of Cedar health system clients. ↩︎