Every day, healthcare providers extend credit to people they don’t know. They do it without collateral or credit history. What’s more, they’re allowing patients to stretch payments over months, with opportunities to adjust or extend terms as needed. Doesn’t make much sense from a business perspective, right?

You might be surprised. With the right payment plan strategy, providers are creating a win-win: patients get the flexibility they need, while providers turn collections into reliable net revenue. In fact, top performers are seeing 95% recovery rates on their payment plans. That’s cash that could be forecasted down to the dollar.

Using objective industry benchmark data and Cedar’s own client performance, we’ll show you exactly why payment plans should be at the center of your patient financial experience strategy.

Payment plans tend to get a bad rap

Many leaders remain skeptical of offering payment plans broadly—and understandably so. Operating on thin margins even in the best of times, providers naturally prioritize faster collections to maintain working capital and invest in care delivery. Why would you offer a payment plan if there’s a chance that a patient will pay in full?

But focusing solely on speed of collections misses the bigger picture. When patients lack flexible payment options, they may have no choice but to borrow money from relatives, rack up high-interest credit card debt, skip payments, or even declare bankruptcy. These patients—and their families—are more likely to experience financial hardship or avoid future care, which may impact health outcomes.

Importantly, we’re not just talking about self-pay patients with large bills. Cedar client data shows that over 80% of payment plans created in 2023 were for balances after insurance—a clear signal that rising deductibles and cost-sharing are changing how once reliable payers need to pay for care.

Now you might be thinking: if you offer more patients payment plans, won’t they just game the system? That’s not what we’re seeing. According to our 2024 annual consumer study, 72% of patients say affordability, not willingness, is their biggest reason for not paying large medical bills. Even more compelling, our client data reveals that 99% of patients on payment plans don’t abuse them—meaning they’re not indefinitely delaying payment by modifying plan terms.

The numbers tell a different story

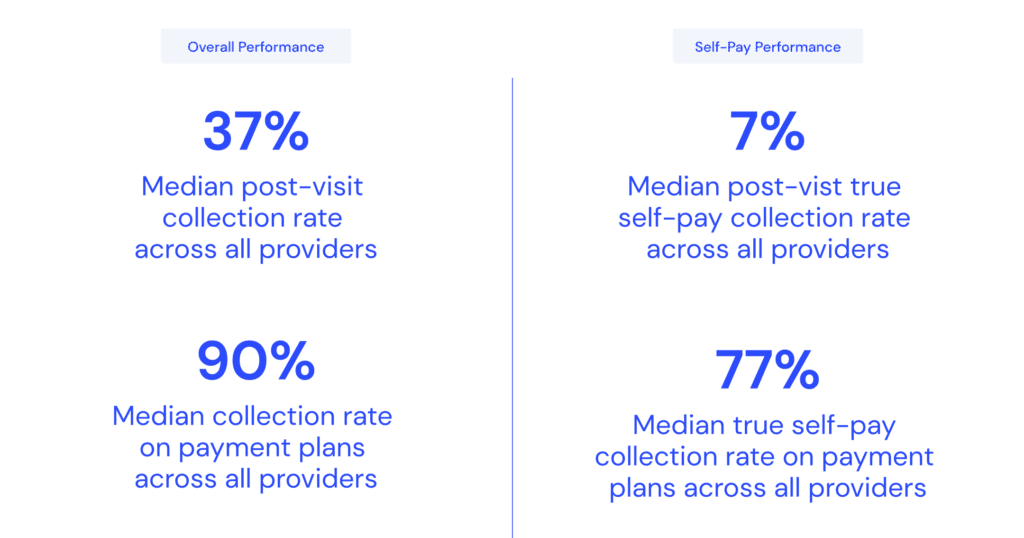

Perhaps the most powerful argument for payment plans, though, comes from rethinking what we consider “collectible.” As with any data, it’s a matter of perspective.

For example, our 2024 PFX Benchmarks show that while the median provider across the industry collects just 37% of patient balances post-visit, payment plans achieve 90% recovery rates. That 53% delta represents net revenue that’s currently being treated as uncollectible—much of it written off to bad debt—when it could be turned into reliable cash with the right payment options.

Reframing recovery rates to highlight payment plan success

The impact is particularly striking for self-pay patients. Without payment plans, providers typically collected just 7% of those balances in 2023. With payment plans? That number jumped tenfold to 77%. Of course, payment plans aren’t enough for every patient—many need coverage or financial assistance to make care truly affordable. But for patients who can pay over time, the data shows that flexible payment options can make a material difference.

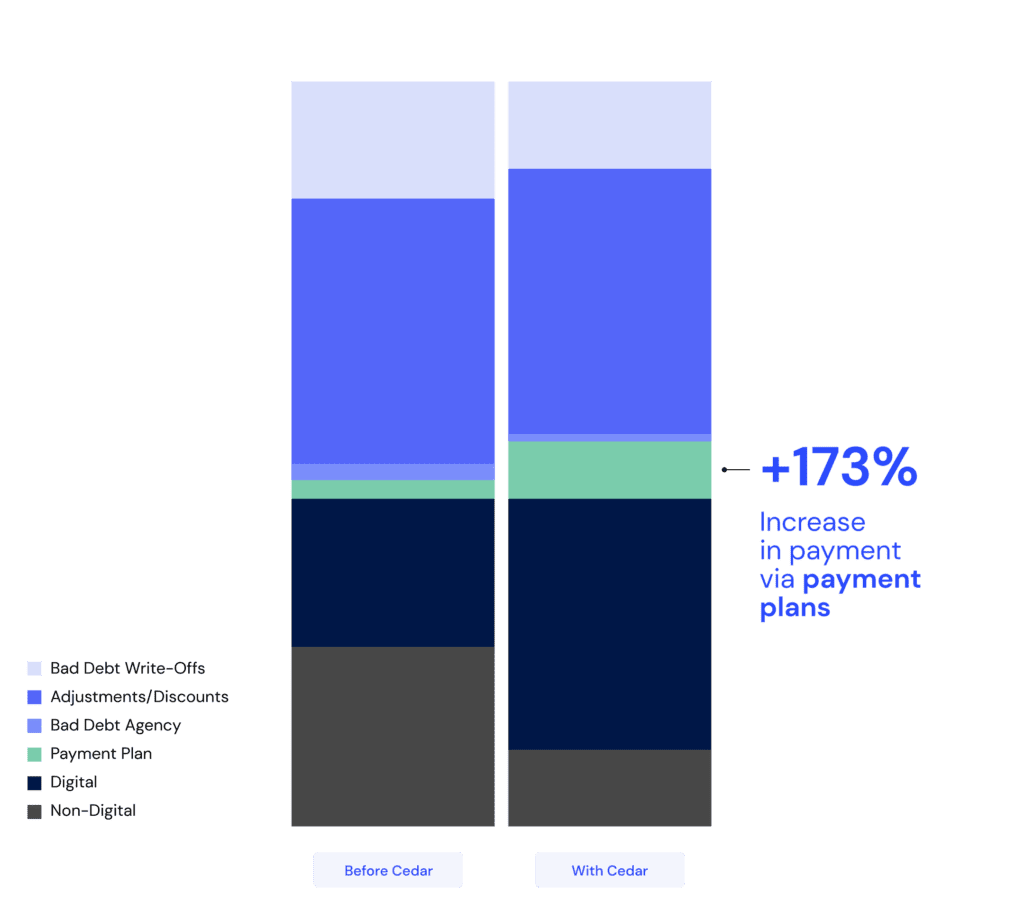

And this isn’t just theoretical. After implementing Cedar, one Epic health system saw their share of patient responsibility on payment plans increase by 173%. This helped drive an over $15 million increase in patient payments in just twelve months. Better yet, the increased adoption of payment plans contributed to reductions in both bad debt agency placements and write-offs, saving patients the stress of getting sent to collections.

Patient responsibility ($) breakdown at an Epic health system

Not all payment plans are created equal

So how can revenue cycle leaders achieve the best results with payment plans? By continuously testing and measuring what works. Through years of analyzing millions of patient interactions, we’ve found that even small adjustments can have outsized impacts on both patient satisfaction and collection rates.

Take guardrails, for instance. At one Cedar client, we recently saw that payment plans on bills between $300 and $303 significantly outperformed those on bills between $297 and $300 when given slightly longer terms. Seeing how just a $4 difference could potentially trigger different payment plan options, getting balance thresholds right (among many other factors) is crucial for optimizing performance.

Bottom line

Helping a patient get onto a payment plan is one of the smartest things providers can do for their revenue cycle. Simply put: it’s patient responsibility you’re far more likely to collect, while easing financial burdens for patients. Sometimes the best business decision is also the right thing to do.

Want to understand how your payment plan performance compares to industry benchmarks? Request a complimentary PFX Benchmarks analysis today to see where you stand and identify opportunities for improvement.

Alli Eschbach is Senior Director, Value Engineering at Cedar