One theme that has recently gripped many of us working in healthcare is the boiling over of consumer frustration regarding healthcare affordability. From social media platforms to Op-Eds to talk shows, it’s hard to miss the vitriol in consumer sentiment. No matter the corner of healthcare, leaders across payers, providers and pharma have been surprised by the intense lack of trust in our healthcare system.

Should we be surprised? We have long lamented the expense of our healthcare system. In 2009, a bipartisan Congressional task force published a 51-page report entitled “The Unsustainable Cost of Health Care.” Since then, U.S. healthcare costs have grown 42%.

Much of these “unsustainable” cost increases have been absorbed by consumers. In 2006, 4% of insured workers enrolled in a high deductible (HDHP) plan; today, over half of Americans are managing high deductibles.

The rise of the high deductible has transformed the patient relationship to healthcare. Remember the $10 copay? Simple, salient, affordable. For decades, the copay defined the patient financial experience. Providers needed little more than a payment device at the front desk.

But now, predictable copays have evolved into unexpected $4,000 bills. Simple transactions at point of care are now multi-month collections efforts. At best, paying these bills is a nuisance; at worst, patients seeking care must face new suffering, from garnished wages to credit score impacts to personal bankruptcy. Healthcare wins the ignominious honor of driving the most personal bankruptcies in the U.S., impacting 400,000 Americans alone last year.

Aside from the impact on patients, the complexities of billing have turned providers into unsecured debt collectors, chasing customers for bills that are increasingly never paid. In no other sector of our economy do we oblige the merchant providing a service to also run a consumer finance arm to chase payment for that service.

For some, this is old news. High deductibles are a billing nightmare for patients and providers. At Cedar, we identified the HDHP trend years ago, and we have successfully equipped providers with better tools, such as personalized communications and payment plans, to manage this trend.

But just as we anticipated the impact of HDHPs, our experience across more than 30 million patients has surfaced a new reality: the magnitude of uncovered care. Our research found that uninsured patients – who are 8% of the US population—now account for 35% of all patient out of pocket dollars owed to hospitals, an increase of 8% year over year. In other words, almost half of all dollars that hospitals must collect are from patients with no coverage. Uncovered patients often have balances that are $10,000, $20,000 or even higher.

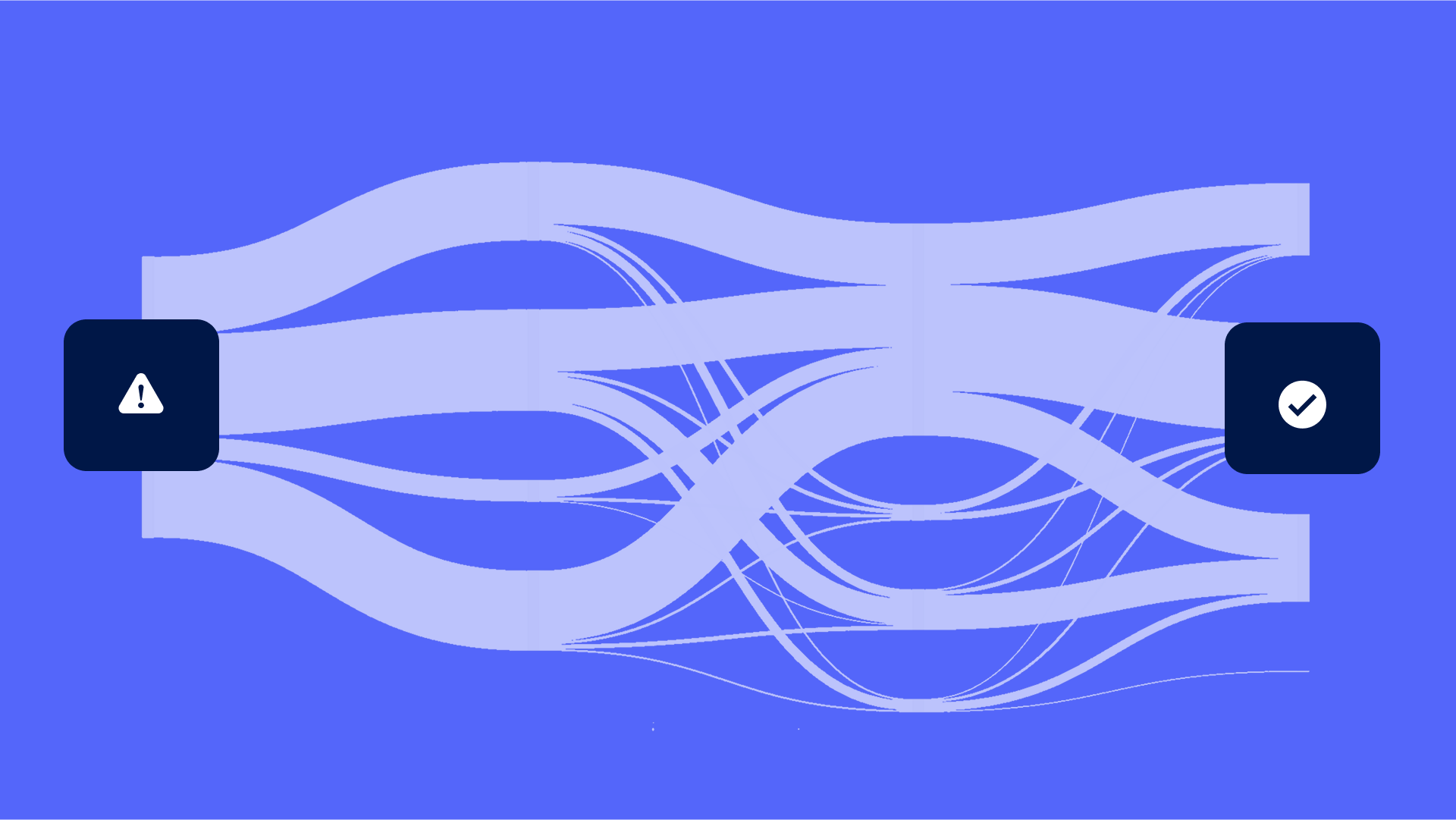

Collecting from uninsured patients is not a billing problem. Billing functionality, like texts from an EHR, won’t help a patient staring at a $10,000 bill. Rather, this is an affordability problem. In fact, Cedar’s research reports that 72% of consumers say affordability, not willingness, is the biggest challenge to paying larger healthcare bills.

This wave of uninsured patients comes on top of the steady rise of underinsured patients; and together, these trends require a different model of engagement. Before even thinking about a bill, providers must now help patients navigate to resources available—from enrollment in Medicaid and ACA plans, to health benefit accounts, to financial assistance and charity care, to pharmacy copay assistance. Connecting patients to the right resources upstream is the financial equivalent of high-quality preventive care, mitigating undesirable (billing) outcomes downstream. The good news is that there are many resources available to patients. But navigating to these resources is hard. This is the era we are in now. This is the era of navigation.

Cedar is ready to meet the moment with the first patient affordability solution in the market—delivering financial “preventive care” that advances a mission of healing while solving margin challenges impossible to address through billing functionality alone.

More than 20 million Americans have medical debt totaling $220 billion. With so much underinsurance and uninsurance, navigating each patient to the right resources at the right time is more urgent than ever. If you think that billing alone is the problem, you’re missing half the story.

Seth Cohen is President at Cedar