The One Big Beautiful Bill Act, signed into law on July 4, 2025, shortens Medicaid retroactive coverage starting December 31, 2026. Expansion adults will see their coverage window reduced from 90 days to just 30 days, while traditional Medicaid populations will see a reduction from 90 to 60 days. These changes erode a long-standing safety net—one that keeps patients out of catastrophic medical debt and gives providers a second shot at reimbursement.

This and related policy changes are projected to drive $434 billion in additional hospital uncompensated care costs by 2034.1 With less time to secure coverage for the most vulnerable populations, revenue cycle teams face a tough new reality: helping more patients, in both high-touch Emergency Department (ED) settings and overlooked ambulatory sites—with fewer chances to get it right.

Why prioritize overlooked low-acuity, low-dollar cases? The longer window once gave these patients time to act—allowing providers to recover some reimbursement, even when enrollment came late. But under the new law, missing these narrower windows means the full financial burden shifts to the patient, and providers are often left absorbing near-total losses on patient balances without insurance coverage.2

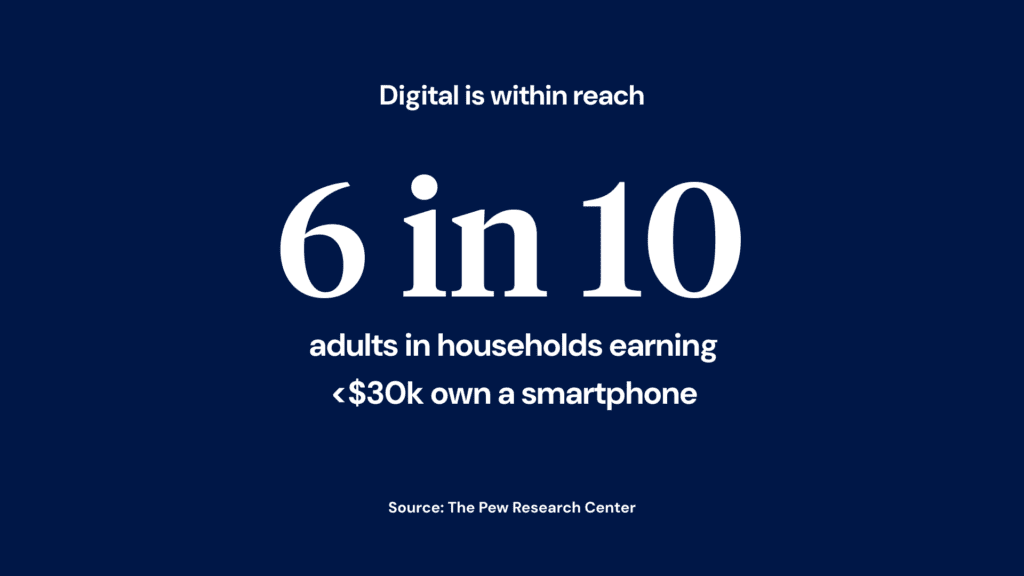

The bottom line: providers must move quickly to identify and assist patients across all care settings, before these windows to secure coverage close. In this new environment, digital tools aren’t nice to have—they’re essential to protecting the organization’s financial health. And revenue cycle teams need new ways to engage patients before, during, and after their care.

Get up to speed on key Medicaid changes in the 2025 Reconciliation Bill with expert Nikita Singareddy from Fortuna Health

Pre-visit: Catching patients before they need a safety net

Traditionally, providers have focused financial counseling on emergency and inpatient settings—and for good reason. Uninsured patients often delay care until it becomes urgent and skip routine or preventive services they can’t afford. These higher-acuity encounters generate larger balances, making manual intervention cost effective.

However, these reduced retroactive windows shift this dynamic. To secure reimbursement, providers must move eligibility and enrollment earlier in the process—ideally integrating automated tools into pre-registration when insurance can’t be verified or cost estimates point to high self-pay balances.

This proactive approach becomes even more critical under the new reforms, as the shortened retroactive windows compound with other disruptive changes. Work requirements, more frequent eligibility checks, and additional administrative barriers will increase Medicaid churn, creating a perfect storm where patients lose coverage more often while having less time to regain it retroactively. All of these changes combined are projected to result in 10 million Americans losing coverage due to these barriers.3

As a result, more patients will arrive believing they have active Medicaid coverage, only to discover their benefits have lapsed. These patients may be unprepared to navigate financial assistance, unsure why their coverage ended, and have little time to resolve it before the window closes.

Digital tools are essential to catch these patients early and streamline re-enrollment—before they rack up uncovered charges or skip care entirely.

During the encounter: Ensuring continuity across settings

The shortened retroactive coverage windows also puts more pressure on in-person financial counseling teams. While boots-on-the-ground efforts are valuable, continuity can break down once a patient is discharged mid-enrollment process. These handoffs often rely on outbound phone calls, which are slow, manual, and easy to miss.

Digital solutions can help close that gap. Low-acuity ED patients can scan a QR code or get a text to start enrollment privately, at their own pace. High-acuity patients can begin once they’re stabilized or moved to an inpatient unit. And crucially, they can finish the process from home, picking up exactly where they left off rather than starting over or waiting for a callback.

Without that continuity, each day lost to phone tag or outdated contact information shrinks the limited window to secure coverage and reimbursement. Digital engagement can create an unbroken thread from bedside to home, keeping patients on track to complete enrollment.

Post-visit: Reaching patients before time runs out

Once patients leave the facility, the countdown begins in earnest. This is where timely digital outreach and engagement becomes critical—whether it’s nudging patients who already started applications, or prompting enrollment opportunities in financial communications.

Billing reminders are proven motivators: our data shows 7 in 10 patients who engage with targeted digital communications go on to begin the Medicaid enrollment process.4 But timing matters more than ever. Providers need the ability to send this outreach immediately—not wait for billing cycles or statements to be generated.

When patients do engage, the application process must be streamlined for the tighter timelines. Pre-filled forms using data on file, simple document uploads, and real-time error checking become essential when every day counts.

Speed of processing also becomes crucial in this compressed window. Cedar’s Medicaid enrollment partner, Fortuna Health, is committed to reviewing and submitting Medicaid applications to state- or county-administered agencies within 24 hours after completion.5 That kind of turnaround can mean the difference between securing retroactive coverage and losing it entirely.

Building the digital safety net

The One Big Beautiful Bill Act’s Medicaid changes shouldn’t rest solely on providers, especially when many are already facing significant financial strain. Yet, when patients need support and access to care is at risk, providers rise to the challenge—just as they always have.

Stepping up doesn’t require relying solely on traditional, labor-intensive approaches. A digital safety net equips teams with tools to reach more patients, across more settings, and with greater speed. It doesn’t replace human effort—it amplifies it, ensuring fewer patients slip through the cracks due to paperwork delays or limited staffing.

Want to dig deeper?

- Read our executive brief to learn how providers can leverage technology to adapt operations for the Medicaid and ACA reforms

- Watch my conversation with Nikita Singareddy of Fortuna Health for proactive steps providers can take to get ahead of the changes

Joanna Jamar is Sr. Director, Commercial Strategy at Cedar

- Nelb, R. (2025, June). Additional hospital uncompensated care costs projected under proposed Senate revisions to H.R. 1 [Policy brief]. America’s Essential Hospitals. https://essentialhospitals.org/wp-content/uploads/2025/06/Additional-Hospital-Uncompensated-Care-Costs-Projected-Under-Proposed-Senate-Revisions-to-H.R.-1.pdf ↩︎

- Cedar. (2023). Median post-visit patient collection rate for self-pay patients across Cedar health system clients. ↩︎

- Congressional Budget Office. (2025, July 8). Estimated budgetary effects of Public Law 119-21, to provide for reconciliation pursuant to Title II of H. Con. Res. 14, relative to CBO’s January 2025 baseline. https://www.cbo.gov/publication/61570 ↩︎

- Cedar. (2024, December). Percentage of patients who view the financial assistance page in the Cedar portal who click get started and begin the Medicaid screening process at a Cedar health system client. ↩︎

- Cedar (2025, June). Based on service-level agreement between Cedar and a Medicaid enrollment vendor. ↩︎