If you were to blindfold a dozen patients with health savings accounts (HSAs) and ask them what their current balance is and how exactly they can use those funds, you’d likely get the same puzzled look again and again.

Ironically, consumer-driven health plans—insurance plans paired with tax-advantaged health benefit accounts like HSAs—are supposed to help patients become empowered consumers of healthcare services. Yet patients often don’t fully understand these benefit designs and struggle to manage their plans.

The result:

- Patients underfund or underutilize their health benefit accounts, missing out on opportunities to save on care and paying bills out of pocket.

- Providers get saddled with managing patient payments, with more than half of what they write off coming from balances after insurance.

- Payers are implicated for poor coverage, as members perceive insurance plans to be useless until they hit their deductible.

All of this led us to a big question—what if providers and payers joined forces to tackle this problem? We knew that most major payers have partnerships with HSA banks, and we suspected providers could leverage these connections at critical moments along the patient journey.

Before we got to work on a solution, we wanted to learn more about the people behind health benefit accounts. Specifically, what had been their experience using them, how have they used them, and importantly, what stopped them from using them more?

Capturing the voice of the patient

To answer these questions, our research team conducted in-depth interviews with patients with HSAs and medical flexible spending accounts (FSAs). Our goal was to understand behavior patterns for how these patients fund and spend with their health benefit accounts and identify barriers to utilization.

Here are the biggest takeaways from those conversations and recommendations for how providers and payers can respond:

1. Patients don’t “miss the money”

Some people don’t think twice about their automated payroll deductions like insurance premiums and 401k contributions. They get used to the money coming out of their paychecks and don’t have to make tough decisions about what to do with it (e.g., spend on present needs vs. save for retirement).

We see the same happen with health benefit account contributions.

“I never miss the money because it automatically comes out of my paycheck.”

But what’s interesting is that when patients go to use these funds, it sometimes feels like it’s not their money.

“I don’t want to pay with my own money, I’d rather use my HSA.”

We think there’s an opportunity to capitalize on this perception and encourage patients to use their contributed funds. One way to do this is to frame HSAs and FSAs as payment options that won’t impact a patient’s monthly budget. Not only does this help alleviate the psychological pain of paying, but it also promotes affordability.

2. It’s hard for patients to use the money

For both HSAs and FSAs, patients report high-friction experiences when trying to spend their funds.

Patients are often unsure of their account balances and frequently encounter issues when logging onto their HSA bank’s portal.

“I get locked out of my account half the time.”

There’s also confusion around what healthcare expenses are eligible for coverage, and patients must labor through online databases or print resources to find this information. As a result, we see some patients actively trying to avoid the reimbursement process—which can be cumbersome—by only paying for expenses they know will get covered.

Additionally, banks may have additional rules around using funds that are opaque to patients. For example, if a patient mistypes their CVC twice, the bank may freeze their card. If a patient forgets to provide documentation for a visit from the previous year, the bank may suspend their account until they claw back the funds.

And sometimes, patients just forget that they have a health benefit account.

“At the moment, I didn’t think of using the HSA card.”

To reduce friction and increase utilization, providers can provide clarity to patients around which charges are considered eligible expenses and explore opportunities to bring HSAs and FSAs into the patient billing workflow. For example, Cedar partners with payer Highmark Health and provider Allegheny Health Network to surface real-time health account balances in outbound billing reminders and the online payment portal.

3. HSA and FSA patients behave differently

As expected, the FSA “use it or lose it” factor profoundly impacts patient behavior. The Employee Benefit Research Institute estimates that about 48% of FSA accountholders carried a balance at the end of 2020, forfeiting $409 on average.

It leads some patients to opt out of FSAs because they lack confidence in their ability to plan or may have even lost money in the past.

“I wanted the tax benefits but I know myself and was worried about leaving money on the table.”

Those who opt-in to FSAs are more likely to spend their funds frequently but may underfund their accounts, forcing them to pay out of pocket.

“I don’t want to waste money and am nervous about having extra money with an FSA so I typically undershoot and run out.”

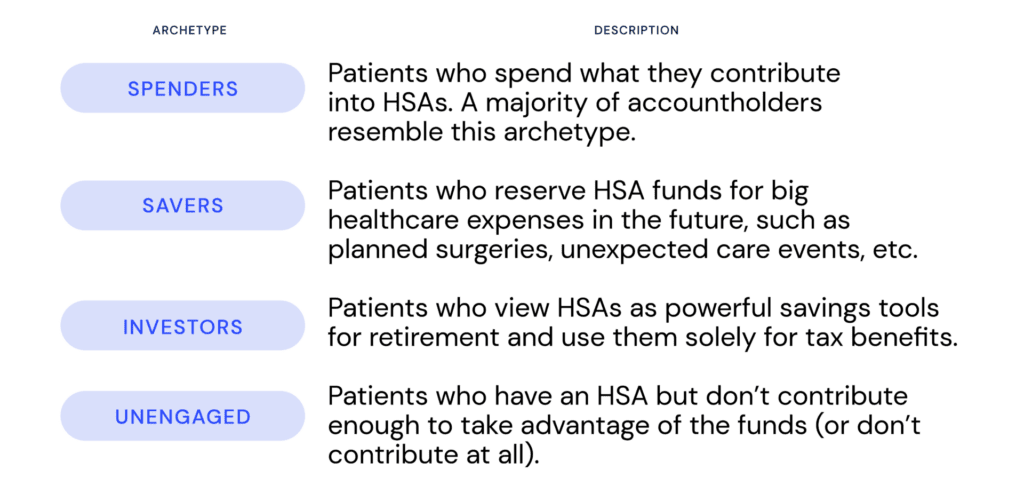

For patients with HSAs, we see four distinct behavioral archetypes—spenders, savers, investors, and unengaged:

Bottom line: HSAs and FSAs influence different patient behaviors and this creates opportunities for personalization:

- Given FSA funds expire at the end of the year, tailored messaging can remind patients of available funds and encourage usage.

- Targeted educational content can help convert HSA spenders to savers, suggesting they set up a rainy-day fund to ensure adequate savings for future expenses (especially for those that might be unexpected).

- There may be opportunities to guide patients to activate HSAs if insurance verification results reveal they are on a high-deductible health plan or increase their contributions if a cost estimate exceeds their HSA balance.

Realizing the potential of consumer-driven healthcare

We believe health benefit accounts can help patients affordably pursue the care they need while enabling providers to resolve more bills and payers to improve member satisfaction. However, this is only possible if patients are empowered to leverage these benefits to the fullest extent.

See how Cedar is bringing together providers, payers, and HSA banks to help patients get the most from their health benefit accounts, with the Payer Intelligence Layer.

Ben Kraus is a Content Strategy Manager at Cedar

Illustration by Emily Farrell