On Tuesday, December 8, Axios hosted “How We Pay for Health,” an online special addressing the future of health care payments. Broadcast on Facebook, Twitter and LinkedIn, the 30-minute special covered inefficiencies and inequities within the American healthcare system, the role of tech innovation and the future of healthcare payment. Interviewees included Cedar Co-Founder and CEO Florian Otto, Waystar CEO Matt Hawkins and New Enterprise Associates Head of Global Healthcare Mohamad Makhzoumi.

Interviewed by Axios Health Care Reporter Caitlin Owens, Florian Otto kicked off the discussion by explaining how his own family’s negative medical billing experience inspired him to found Cedar in order to offer a high quality healthcare payment option.

After his wife (then-fiance) fainted and had to go to the emergency room, she received a barrage of paperwork with indecipherable billing codes, was offered limited and antiquated payment options and got a collections notice due to provider error. It was then that Otto realized there had to be a better way.

“Millions of patients have the same problem: they don’t understand the medical bills, they don’t get their medical bill, and they land in collections for no real reason,” he said. “Out of the 50 million people that have a bad credit score because of medical debt, half of them have an otherwise clean credit score – and the median outstanding balance is $200 so it’s not an ability to pay problem. We thought, ‘OK. Patients are getting a much better experience everywhere else, why not in healthcare? And that led us to start Cedar.”

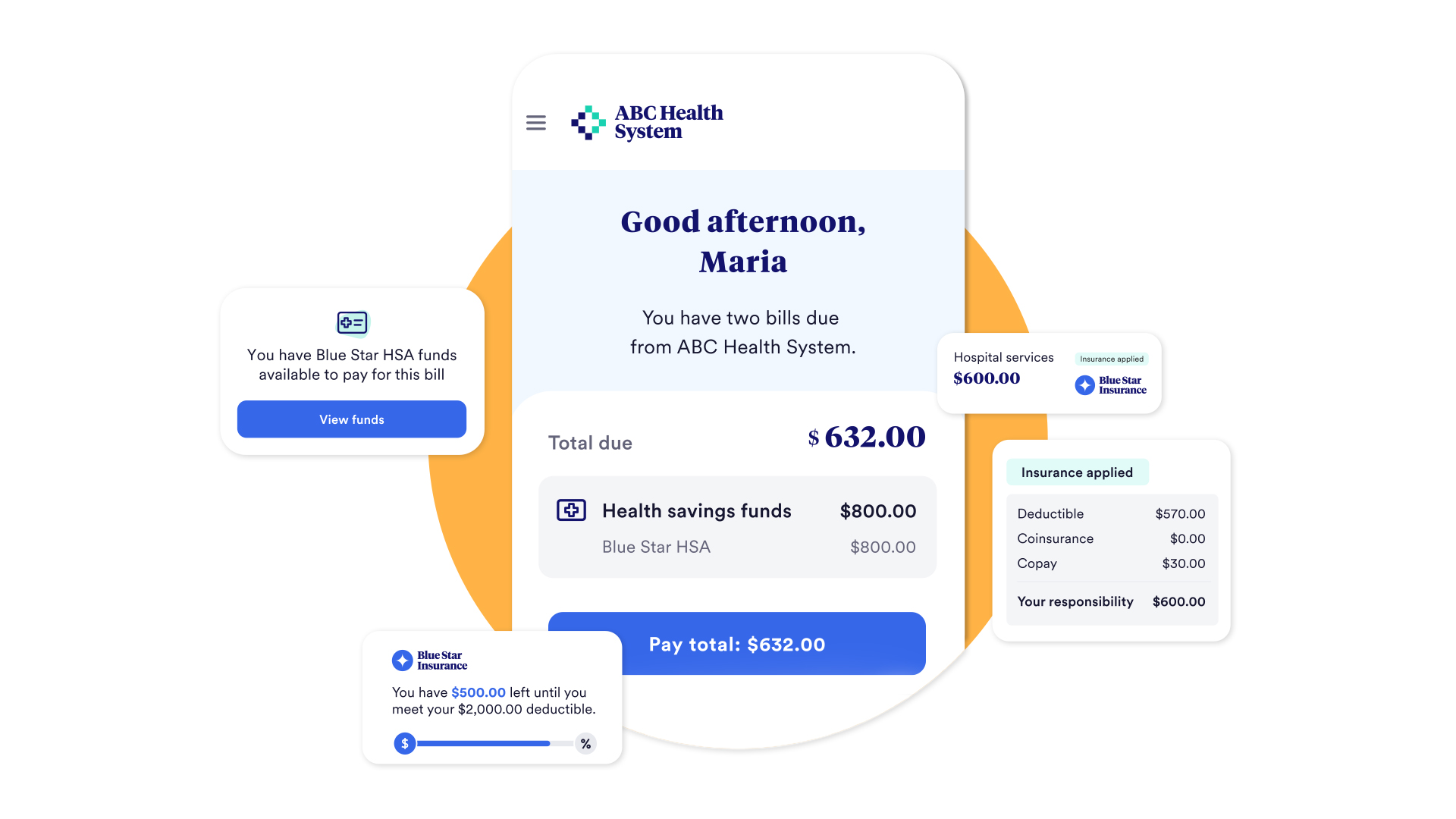

The conversation pivoted to consumer expectations around transparency, convenience and immediacy—and how those expectations should be met in healthcare. Cedar answers with a seamless digitalsolution where it’s easy to review your bill, pay with the most modern digital billing solutions and where all communication is optimized to the channels you prefer.

Before addressing current healthcare payment pitfalls, Otto emphasized pre-visit dissatisfaction. According to Cedar’s recent Healthcare Consumer Experience Study, the worst part of the healthcare experience is pre-visit. “[That the numbers indicate dissatisfaction] makes total sense—you don’t show up on Amazon and get the delivery and then they tell you how much it costs. That doesn’t make much sense.”

The segment ended by focusing on the current state of healthcare policy and 2021’s new legislated billing transparency measures. Otto said he strongly believed the intentions of legislators are good, but expressed skepticism about how health systems would be able to respond positively given their “indigestible” billing language.

According to Otto, broader systemic change will only come about from consumers and employers. “If consumers at some point literally say, ‘OK, we are not doing this anymore and we want a change, then at some point policy will change.”

Otto’s segment begins at 1:20 here.

The payment ecosystem and ‘payment Nirvana’

Next up, Axios co-founder and CEO Jim VandeHei interviewed CEO of Cedar strategic partner, Waystar, Matt Hawkins. Hawkins offered his perspective on the state of current payments and what a best-possible payment system could look like.

“A future state would be using technology to help create a scenario where the patient can know what their financial responsibility is before they ever schedule an appointment or before they ever go visit a doctor,” he said. “‘Nirvana’ will be to present the patient with a payment estimate so that they know what they’re obligated to pay, [bringing] a lot of clarity and integrity to the process. And providers will therefore also know what they will be able to receive for the health services they provide.”

Hawkins expressed “tremendous confidence—more than we’ve ever had” in the next three to five years on this front. He called out progressive providers and vendors who leverage technology to bring clarity and transparency to the healthcare administrative process.

Echoing Otto, he underscored the importance of transparency in the modern marketplace.

“It’s important for consumers as patients to be able to have access to what they’re responsibility will be and be able to not just price shop but quality shop. You can’t shop for quality unless you understand what price is.”

Hawkins’ segment begins at 12:40 here.

Disrupting healthcare in 2020 and beyond

The event concluded with an interview between Axios Healthcare Editor Sam Baker and New Enterprise Associates (NEA) Head of Global Healthcare Investing Mohamad Makhzoumi talking about the state of innovation investing in healthcare.

Makhzoumi said that historically healthcare innovation investment was a dubious proposition due to myriad socioeconomic and political reasons.

“Confidence and healthcare investing rarely go together,” he said. “You’re talking about an industry with unbelievably entrenched incumbents that control massive amounts of market and spend with high regulatory hurdles in a category of the economy that changes from a policy and political perspective every two to four years, with pretty dramatic swings.”

He continued by pointing out that COVID-19 accelerated several nascent but growing trends that have not markedly penetrated healthcare like virtual care, virtual pharmacy, consumer choice and more.

“A lot of things that had been growing slowly around the edges have now been accelerated. You take the aftereffects of the pandemic and you combine it with a lot of these trends particularly around vertical software, data analytics along with consumer choice – you put it all together and I think that’s the moment we’re living in now and it’s candidly one of the reasons we [at NEA] can’t recall a more exciting time to be at the forefront of innovation investment in healthcare.”

He closed by pointing out that to maximize investment in healthcare, while challenging, it’s necessary to find solutions that collectively benefit the patient, clinician/provider and payer (managed care, government/employer).

“Florian Otto is trying to do that in the payment remittance space for revenue cycle and billing and he’s doing a phenomenal job,” he said. “But it’s really hard in payments—[though] I think Cedar could do it.”

Makhzoumi’s segment begins at 21:20 here.