This article is part 3 of our Big Bills series, which focuses on how providers can decrease the burden of large healthcare bills. Click to read part 1 and part 2.

Let’s face it—paying for healthcare is never easy, but rising out-of-pocket costs and inflation are increasingly making it harder for patients to cover their portion of bills. Those with medical debt face impossible choices like cutting back spending on basic necessities, and the cost of care is forcing some to put off treatment altogether. It’s not just patients who feel the pressure, either—providers are facing their lowest margins in decades, and consumer medical debt is estimated in the hundreds of billions of dollars.

All of this puts a finer point on the need to bring empathy to the difficult moments of paying for healthcare.

At Cedar, our team is tackling this problem by focusing on patients with large invoices who are at risk of being sent to collections. We know that payment plans are one way to prevent patients from going to collections, and we have the data to prove it: in a Cedar internal study conducted over a 6 month period in 2021, patients with large bills who avoid collections were 4x more likely to create a payment plan and edit rather than cancel their plan. They want and are willing to adapt their plan to their needs.

The same is true for patients that do unfortunately end up in collections—they’re motivated to take action but are often unable to find an option that works for them to resolve their bill.

After speaking with these patients to more deeply understand their needs, we developed new payment plan features to test the impact of added flexibility. We quickly saw that these features drove higher adoption of payment plans among patients with high balances, putting these individuals on a path to resolution.

If giving these patients a little bit of flexibility was helping them take action on their bills, what more could we do to support them better? To uncover this, we set out to understand how we could offer even more flexibility to provide a better and more affordable financial experience.

A day in the life

As researchers at Cedar, we have the privilege of learning directly from patients, and every day we are blown away by the insights and perspectives they bring to our team. We recently had the opportunity to shadow patients and see firsthand their financial struggles when dealing with surprise expenses.

One mother, in particular, left a lasting impression on us. She received a medical bill that exceeded her monthly salary, her car had broken down, and she couldn’t afford to repair it. Yet, she remained determined to keep moving forward:

“I work and am willing and able to work, so I will make it work. I will take care of my family,” she told us.

Her resilience and unwavering commitment to her family in the face of adversity were truly inspiring.

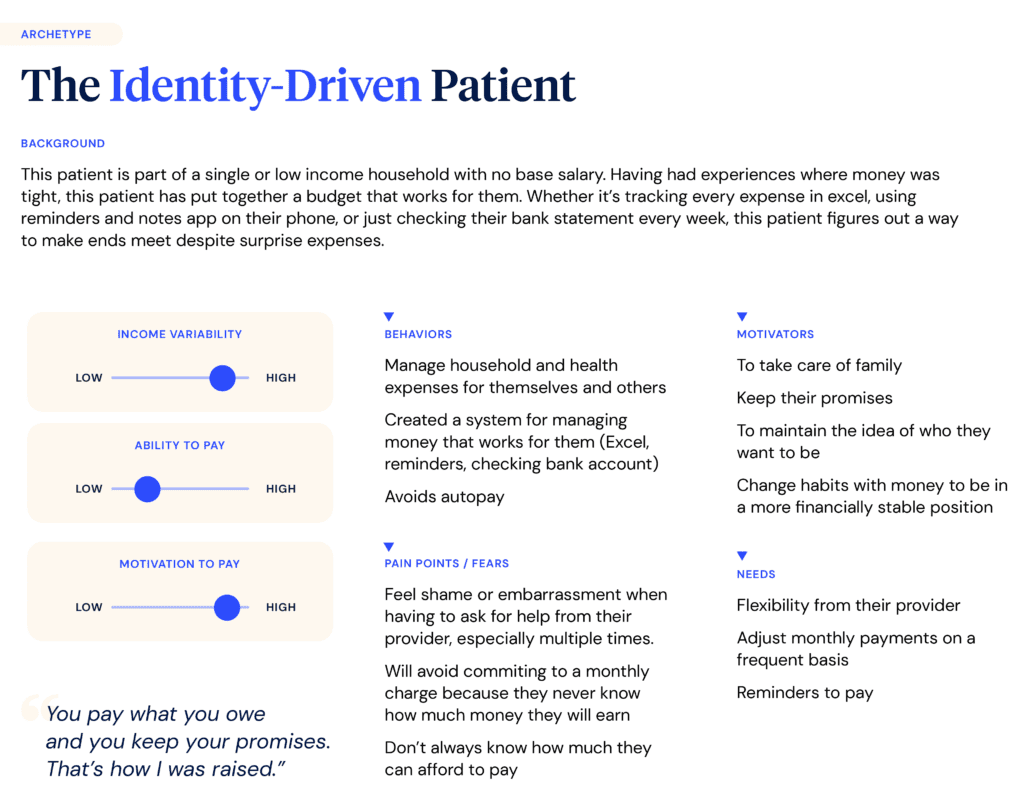

Her experience, along with other patients, led us to a powerful realization: a patient’s ability to pay their bills is not just motivated by a need to pay, but is also tied to their identity and how they see themselves. When patients talk to us about paying off their bills, they also express their desire to be good parents, responsible community members, or keep their promises. For many, having an experience with debt in the past had led them to set an identity-based goal.

The impact of identity in goal-setting

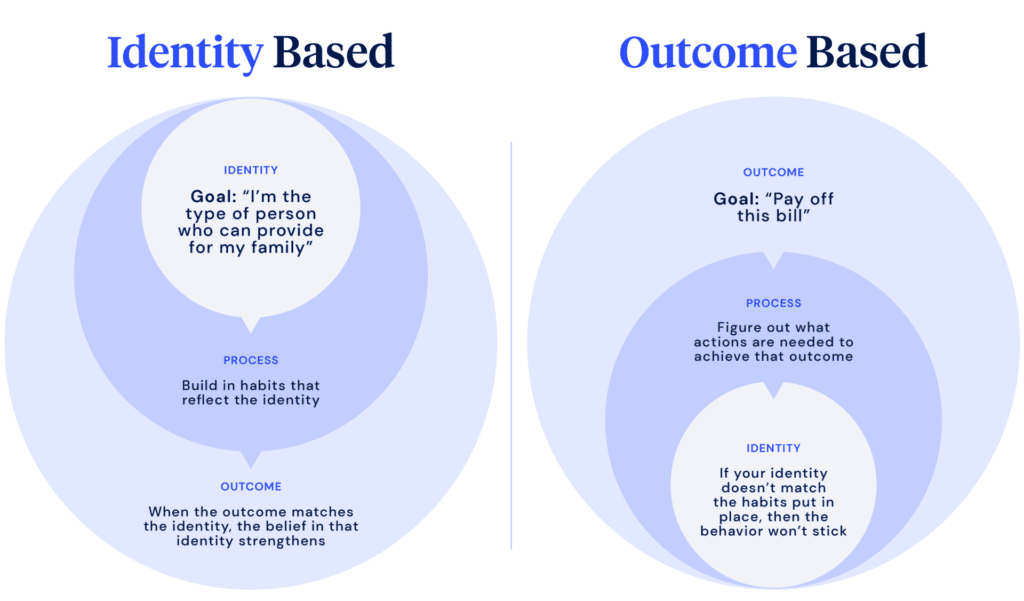

Goal-setting goes hand in hand with motivation; it gives us a target and propels us in that direction. If you think about some of the goals you’ve set in the past, you likely landed on an outcome-based goal, which focuses on the result you want to achieve. In contrast, identity-based goals are founded on what you believe about yourself—by altering your identity or who you want to be, you are more driven to change behavior because you think you can. Think about the last time you set a goal, whether it was at work or in your personal life. Can you remember what worked or didn’t about that goal? Was it focused on an outcome, or were you embracing a new identity?

As a former researcher in the health and wellness space, I have seen firsthand how identity-based goal-setting can transform motivation. Other companies have also been successful in taking this approach. Fabulous, a habit-building app, grounds its design in this behavioral science framework. A critical component of their program is setting identity-based goals that embrace a mindset shift from “I want to lose weight” to “I am someone who prioritizes my health,” setting a strong foundation for implementing new habits.

So what does this look like for patients with medical bills? Let’s walk through an example:

An outcome-based goal for one patient could be: “I want to pay this bill.” This goal focuses on the result.

An identity-based goal could be: “I am someone who is financially responsible and can provide for my family.” This goal focuses on what you believe about yourself.

Let’s break this down further with the identity-based goal framework.

The innermost circle is your identity, who you believe yourself to be.

“I am someone who is financially responsible and can provide for my family.”

Think about it, if patients believed, “I’m not someone who can keep track of finances,” then they wouldn’t imagine ways in which they could. But changing their internal dialogue to “I am someone who can…” makes all the difference. Embracing a positive identity sets them up to build habits that align with the needs of providers.

The second circle is the process or habits you create that are driven by who you believe yourself to be.

“Even though my income fluctuates, I do everything I can to pay off my expenses and provide for my family.”

For patients, this could be a budget in excel or a notebook, phone reminders for bills, or checking their bank account weekly to know how much money was going in and coming out.

The outermost circle is the outcome or the results of your actions.

“Even though I don’t know how much I’m making each month, this approach helps me know how much I can afford, and I know I can get through it.”

The more a person sees that they are making progress, the more they own that new identity.

With an outcome-based approach, your belief in yourself can get in the way of achieving the outcome. It doesn’t matter what goal or habits you set; it’s nearly impossible to change a behavior without starting with identity.

The identity-driven patient

Another patient we talked with had set a goal, “I want to pay off this bill,” focusing on the outcomes. She had never been taught by her parents how to manage money and didn’t believe she was the kind of person who could.

After having a family, she actively changed that.

“I want to be the kind of mother that can talk to her kids about money. I want them to understand where it comes from and where it goes. I have to set that example.”

She set an identity-based goal to change her relationship with her finances. Adopting this new identity, she set up reminders and built-in habits that helped her stay on top of her bills despite her unpredictable income. The outcome, making progress towards bills and being more open with her kids about money, confirms her new identity and strengthens that belief.

Patients are more aligned with providers than you think

By forming an identity around these goals, like “keeping promises” or “showing up for their family,” patients are more likely to change their behavior and create habits that reflect their ideal identity. This doesn’t mean that patients who can’t pay just don’t know how to budget. Instead, when faced with financial hardship, identity plays a massive role in the belief that they can make progress toward their bills and maintain the motivation to continue trying.

In our data, these patients expressed interest in our payment plan. Still, they didn’t sign up—not because they didn’t want to, but because they didn’t see how they could with their unpredictable income. Behind the numbers, these patients are doing what they can to make payments. They are motivated to do so because of the identity-based goal they set for themselves.

Based on these learnings, we can design with patients’ ideal identities in mind by taking our payment plans through the lens of the identity framework. For example, right after a patient has set up a payment plan, instead of just confirming, “Your plan was created”, we can say things like “You are on your way!” to show them they are someone who actively works towards their financial goals. This positive mindset can impact their habits beyond just paying for this one bill and may lead to better financial decision-making in the future.

At the heart of our work is the belief that understanding patients goes beyond collecting feedback. It’s about stepping into their shoes and experiencing the world as they do. It’s not just patients who benefit from this empathetic approach—our providers do too. Patients and providers are more aligned than we think. By building trust and flexibility into payment plans, we can empower patients to become the best version of themselves, all while deepening their relationship with their providers.

Lana Cohen is a Senior User Researcher at Cedar.