This article is part 1 of our Big Bills series, which focuses on how providers can decrease the burden of large healthcare bills. It was originally published on The Patient Experience Studio on Medium, where Cedar’s Product Design and Data Science teams share a behind-the-scenes look into how we’re building a better financial experience.

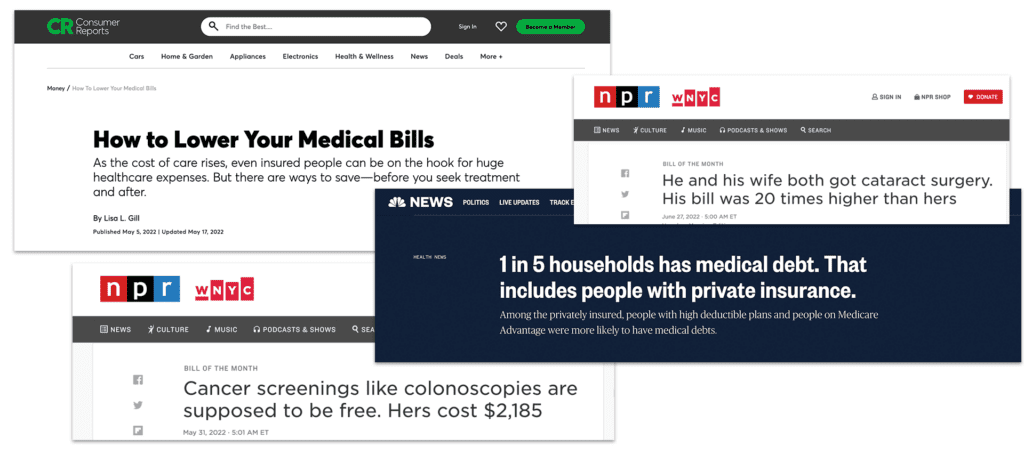

Here at Cedar, we are committed to solving the highest-impact patient problems. Decreasing the burden of big bills in an empathetic and human manner lands on the top of that list. We have heard from countless patients that big healthcare bills are a primary driver of worry and stress. These painful experiences with big bills have been highlighted in the media, are prevalent in our user research and are surfaced through the feedback we receive from patients.

But first: how “big” is a big bill? We saw in our data that patients with balances greater than $1,000 over a six month period represented only 13% of patients billed post-visit. Yet, their balances aggregated constituted more than two-thirds of the outstanding balances at large health systems—and, more than 50% of these patients are sent to collections. We chose $1,000 as the balance cut-off since we observed that patient behavior and representation was relatively similar for groups above this threshold; this group stood out to us as the largest group that would need additional help to resolve their bills.

In order to understand how we might help these patients, we knew we needed to dig into the data to understand what was happening. So, we looked into the profiles of patients with big bills to understand their experience—and where we could improve it.

Where do big bills come from?

While there are many patients who receive big bills for one-time visits, our data analysis has found that patients with big bills are the ones who tend to go to the doctor more often. They have almost double the number of healthcare visits over a six month period—often due to serious healthcare scenarios or chronic conditions—compared to patients with small bills. On average, there were 10 days fewer between their visits to their healthcare provider compared to patients with small bills. They were also twice as likely to have monthly visits.

Not only do these patients tend to go to the doctor often, but their healthcare visits tend to be complex. Even though they go to the doctor only twice as often as patients with small bills, they have 10 times the number of line items on their bills, and also tend to have visits that cover more varied healthcare services.

When it comes to engagement with Cedar’s platform, we saw that patients with big bills were more engaged than patients with small bills. Around 70% of them had engaged with Cedar—compared to 60% for patients with small bills. This is likely because of the long, involved healthcare journeys that these patients have. As a result, patients with big bills spend a large amount of their time and energy on managing and trying to resolve their healthcare balances.

How do we help patients with unpaid big bills?

The goal of our research was to pin down the problems that patients with big bills faced—so that we could design solutions to address them. So, we looked further into patients who had unpaid big bills. In our analysis, there were clear demographic trends that surfaced:

- These patients tend to be younger, with an average age of 47. On average, this is three years younger than patients with big bills who are able to pay, and eight years younger than patients with small bills.

- These patients also tend to reside in lower-income zip codes. This group of patients likely have fewer resources available to help with their healthcare bills; even when they have insurance, it covers less of their bills in comparison to patients with small bills or patients who are able to resolve their big bills.

- However, despite having fewer resources, these patients are also motivated to pay. Of the users who engage with our post-visit billing and payment solution, Cedar Pay, 45% reach the regular checkout stage and 32% of them reach the payment plan checkout page. They’re interested in the available payment options—but just can’t find one that works for their financial situation. The motivation to resolve their bills is there, but they’re lacking the flexible options to do so.

So—what solutions do patients with big bills need?

From this research, we learned that patients with big bills (when they are able to make payments) prefer payment plans as their payment option of choice; nearly a third of patients with big bills pay their balance down with a payment plan. However, payment plans with fixed, large installment amounts, which is the industry standard, are not enough to help patients with big bills who need more support—especially as patient financial circumstances can vary, and change quickly.

Nearly a third of patients with big bills pay their balance down with a payment plan

There is also a large role that providers can play in supporting patients with fewer resources but high motivation and connecting them to appropriate financial aid resources. As they stand currently though, financial aid options can be complex, cumbersome and slow to take effect. They need to be surfaced in a way that’s targeted and easily actionable.

In collaboration with our Research and Design teams, we took the insights we gathered from this quantitative analysis and spoke to actual patients. Stay tuned for our next blog post on what we learned and what we’re doing next.

Stewart Kerr is a Data Scientist at Cedar.