Every fall, millions of Americans shop for health plans as open enrollment begins. But this time feels different. It’s less about choosing between plans and more about choosing what to sacrifice.

That’s because we’re approaching an inflection point in healthcare affordability that will reshape who gets covered, how they access care, and whether providers get paid.

First, pandemic-era ACA subsidies are set to expire at the end of 2025—subsidies that doubled marketplace enrollment and made coverage affordable for more than 20 million Americans. Then come Medicaid reforms, projected to strip coverage from millions, with many cycling between uninsurance and marketplace plans with high deductibles.

When subsidies disappear, premiums rise. And healthy people with modest income decide coverage isn’t worth the cost and drop out. That leaves a smaller, sicker risk pool, which drives costs higher. And the cycle doesn’t stop at the exchanges.

It reaches employer insurance plans too. As marketplace instability increases uncompensated care, providers pass those costs through to commercial payers.

According to KFF data reported by The Wall Street Journal, the average family health insurance plan through an employer now costs just under $27,000 (up 6% from last year). That’s the third consecutive year of steep hikes, rising faster than inflation. Economists and business leaders worry the trend will suppress wage growth and hiring.

The result: a healthcare system where having insurance no longer means you can afford care. And for providers, the old playbook for collections—built on neat categories like “commercially insured” and “self-pay”—no longer applies.

Meet ALICE: the new plurality

To understand the challenges ahead, ALICE offers a helpful framework.

ALICE households, families that are Asset Limited, Income Constrained, and Employed, earn above the Federal Poverty Level but still struggle to make ends meet. They now represent nearly one in three U.S. households, and soon there may be more of them.

Why? Because the safety nets that once kept families afloat are fraying all at once. Add rising medical costs to groceries, rent, and other essentials, and monthly budgets can collapse into impossible tradeoffs. For those already struggling, these pressures push them deeper into financial hardship.

Supporting ALICE isn’t one-size-fits-all. These patients move constantly across coverage types, spanning the entire payer mix. As Ashley Anglin, PhD, Director of Research and Strategic Initiatives at United for ALICE, notes, it’s a “constant process of navigation.”

Eligibility, income, and employment status shift frequently, and every change can introduce new barriers to care.

ALICE researcher Ashley Anglin, PhD: “A constant process of navigation”

Watch the full conversation to learn more about ALICE and how providers can support this growing, vulnerable population.

The traditional payer mix is dead

Most revenue cycle teams still rely on three categories: self-pay, government-insured, and commercial. Those buckets no longer predict a patient’s ability to pay or show you how to help.

When an ALICE patient shows up in your ED, the system may label her “commercially insured,” suggesting a high propensity to pay. But from a payment capacity standpoint, she’s effectively self-pay. A $5,000 bill is impossible for her whether she has coverage or not. Your collection strategy treats her like every other commercially insured patient, and when she doesn’t pay on the expected timeline, your team wastes resources on outreach that won’t work.

The gap between coverage status and ability to pay is only growing. And it’s not just ALICE: it’s stretching across the entire middle class as ACA subsidies disappear and employer insurance costs rise. The old categories don’t just fail to predict payment behavior. They actively mislead revenue cycle operations.

Four segments that actually reflect behavior

To support ALICE and other financially vulnerable populations, providers need a new approach that understands patients’ actual circumstances and can adapt as those circumstances change.

At Cedar, we look at bill size and how long balances have been outstanding to ensure patients get the right guidance and resources at the right time. This analysis creates four categories:1

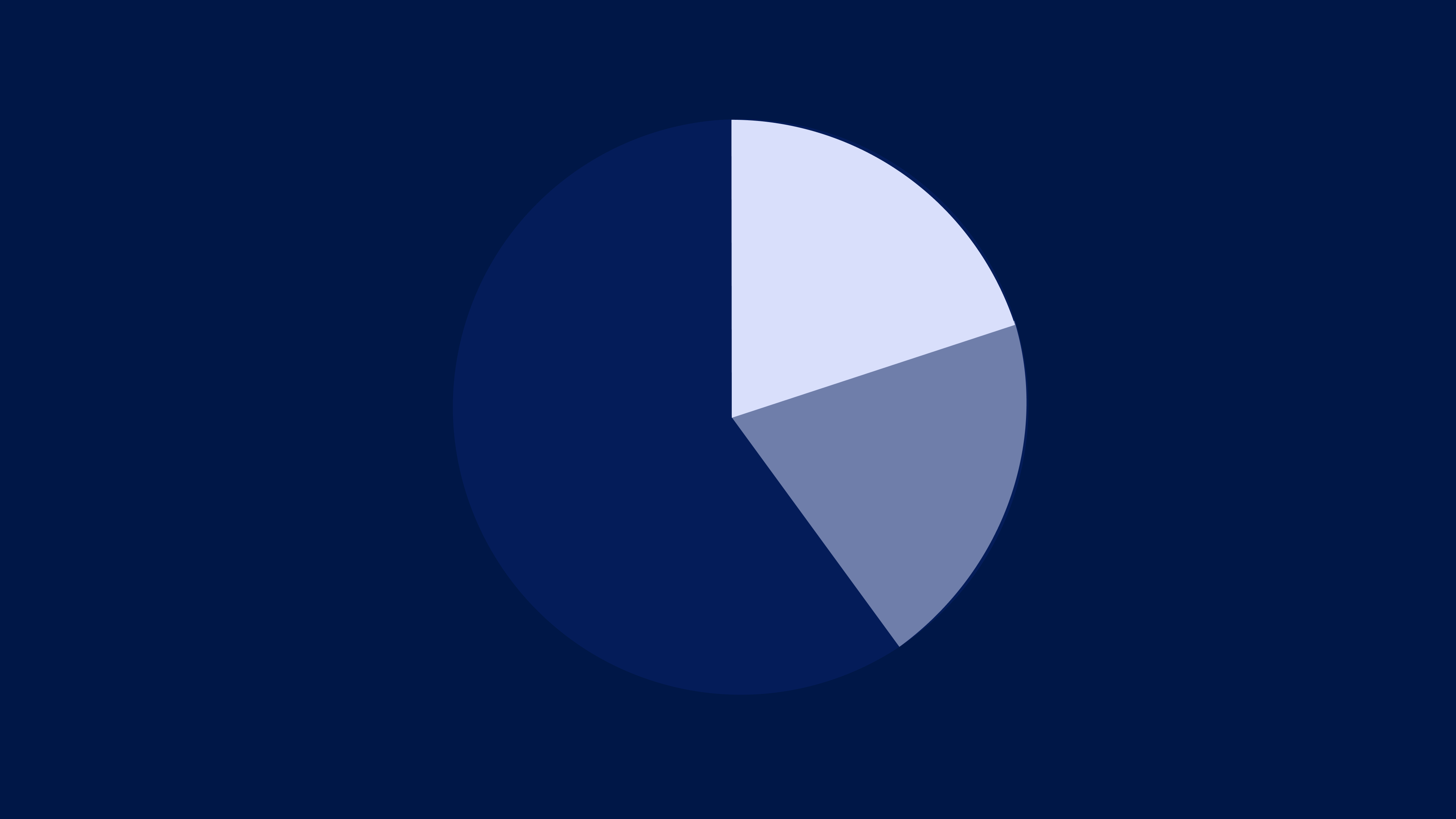

Applied to one health system client, only 28% of patient dollars fall into the “fast and easy” category—digitally engaged patients with good insurance and manageable bills. These are your $20 copays, patients who pay online within 30 days.

That means 72% need specialized collection strategies:

- 14% are small bills but long to collect. Often digitally disengaged or ALICE patients juggling multiple priorities. They need micro-payment plans and persistent outreach.

- 23% are large bills with moderate collection time. Likely traditional high-deductible plan patients. They need easy access to HSA/FSA funds and coverage verification.

- 34% are large bills and longest to collect. Typically self-pay patients, those in health crises, or stuck in denial loops. They need Medicaid enrollment support, charity care navigation, third-party financing, and pharmacy copay assistance.

And the opportunity is massive: $123 billion sits idle in HSA accounts. 97% of eligible patients aren’t using $5 billion in medication assistance. 17% of eligible adults churn out of Medicaid due to procedural reasons and administrative barriers.

The resources and funding exist to help. Patients just don’t know how to access them, and a one-size-fits-all approach will never bridge that gap.

That’s why we built Cedar Cover

Cedar Cover works within the patient’s bill, showing options that actually fit their situation and making it simple to navigate them.

Think of it like GPS for healthcare costs: it meets patients where they are, anticipates obstacles like high deductibles or coverage gaps, and guides them step by step to the resources they can use.

The result: patients get care they can afford, and providers recover revenue that would have otherwise been written off.

Today, patients are weighing affordability at every turn, deciding whether to access care, skip a dose, or delay treatment. But what if affordability was the start of every patient interaction, not something you react to after the bill drops?

Now it can be: Explore Cedar Cover

Ben Kraus is Director, Content Marketing at Cedar

- This segmentation primarily reflects engagement and billing complexity, and is designed to comply with applicable law. It is intended to help providers provide support where it’s needed most, improving both collections and the patient experience ↩︎