After Boosting Patient Payments 42%, ApolloMD Transforms Billing Support with Agentic AI

Partnering with Cedar, the clinical practice management group leads in AI-powered patient financial experience with sustained collections growth.

Location: Nationwide

Source System: athenaOne

Solutions: Cedar Pay, Cedar Support, Cedar Cover

rate in year one1

an AI voice agent2

through automation3

Friction at first contact

For clinical practice management groups like ApolloMD that support and operate emergency departments, patient collections have always been complicated. Patients don’t choose their ER clinician. They show up, get treated, and weeks later receive a bill from a provider they didn’t know was part of their care.

Like much of the industry, ApolloMD had relied on a vendor model and statement-based approach. But as high-deductible health plans became more prominent, patient responsibility jumped from $20 copays to $150 or more per bill.

“We knew we couldn’t just rely on billing payers alone for revenue,” explains Tennille Lizarraga, Chief Revenue Cycle Officer of ApolloMD.

The traditional statement-and-wait strategy wasn’t built for these kinds of balances. For ApolloMD, the challenge was even more acute: how do you collect from patients who don’t recognize your brand? Who often called just to question the legitimacy of a charge?

When ApolloMD met Cedar in 2020, Amy Katnik, Executive Advisor, Revenue Cycle and Strategy, saw a clear opportunity to modernize. But she also knew that turning insight into action would require focus and enterprise-wide commitment.

“Moving from a conventional collections approach to a patient financial experience platform was a deliberate decision,” Katnik explains, “one designed to better support patients while strengthening performance.”

"Patients are already upset—nobody wants to go to an ER. And they don’t always understand that our bill is separate from the hospital’s. It creates a sticky situation."

Amy Katnik

Executive Advisor, Revenue Cycle and Strategy, ApolloMD

Earning patient trust

Since ApolloMD had no direct relationship with patients, limited control over the point of service, and little opportunity to explain the role they played in a patient’s care before a bill arrived, collecting payments required more than a billing system. That’s where Cedar Pay stood apart.

Cedar’s patient financial experience solution gave ApolloMD a way to show up differently with patients, before frustration set in.

Its mobile-first payment experience made it easy for patients to see their balance, understand their charges, and pay in just a few clicks. It delivered the kind of experience patients expect from brands they already trust.

Just as important, Cedar gave ApolloMD control over how they introduced themselves. Customizable billing communications allowed the organization to explain who they were and why a patient might be receiving multiple bills from various providers, addressing confusion proactively rather than reacting to it after the fact.

And Cedar delivered quickly. “It was the smoothest implementation we ever did, with the fastest results,” Lizarraga says. Leadership bought in almost immediately when they saw the collections lift.

But for Yogin Patel, MD, CEO of ApolloMD, the impact went beyond the numbers. “Partnership with Cedar was about meeting patients early in their financial journey, helping them navigate the burden of high-deductible plans, and improving our outreach, engagement, and optionality for our communities,” Dr. Patel explains. “Cedar helped us do exactly that.”

“When you change your outward behavior, patients change theirs. We saw it in patient engagement, satisfaction scores, and the comments they left.”

Tennille Lizarraga

Chief Revenue Cycle Officer, ApolloMD

Driving sustained performance

Within the first year, ApolloMD drove a 42% increase in their overall collection rate. More telling, 92% of collections came from patients who engaged digitally: clicking a link, accessing the portal, paying online.4 The friction that had defined their collection process was gone.

And patients noticed. Across more than 44,000 survey responses, patient satisfaction hit 87%.5

“When you change your outward behavior, patients change theirs,” Lizarraga says. “We saw it in patient engagement, satisfaction scores, and the comments they left.”

What started as a collections fix evolved into a deep partnership to innovate patient financial experience. Between 2021 and 2024, ApolloMD optimized checkout flows, added HSA/FSA integrations, and layered in insurance tracking tools.

One of the most impactful innovations was machine learning (ML)–powered discounts for self-pay patients. For balances between $400 and $5,000—where affordability was the main barrier—Cedar’s ML model helps ApolloMD determine the optimal discount to convert otherwise unpaid balances into payment. This drove a 9% lift in collections for this population, compared to those with no discount.6

Each improvement compounded: easier payments for those who could pay, affordability for those who couldn’t—driving four straight years of cash growth despite economic headwinds. In 2024, ApolloMD collected $48.2 million, the highest in its history and a 14% increase over 2023.7

“One thing I love about Cedar is they’re very purposeful in their design. They do a lot of testing and optimization—what works, what doesn't—all behind the scenes."

Amy Katnik

Executive Advisor, Revenue Cycle and Strategy, ApolloMD

Smarter support with AI

In 2024, ApolloMD expanded to Cedar Support, Cedar’s solution for patient billing support. The rationale was simple: customer service is as critical to the patient financial experience as payments. Every confused call, long hold, or agent who can’t quickly access account details adds friction and erodes trust.

ApolloMD had been working with a previous call center partner that struggled to meet basic service standards.”We had a 10% abandonment rate,” says Katnik. “It would take about five minutes for calls to get answered.”

Cedar’s service center changed that with abandoned calls dropping to under 1% by Q1 2025.8 The turnaround was so dramatic that when Cedar asked ApolloMD to be their development partner for Cedar’s AI voice agent Kora, Katnik said they were “all in.”

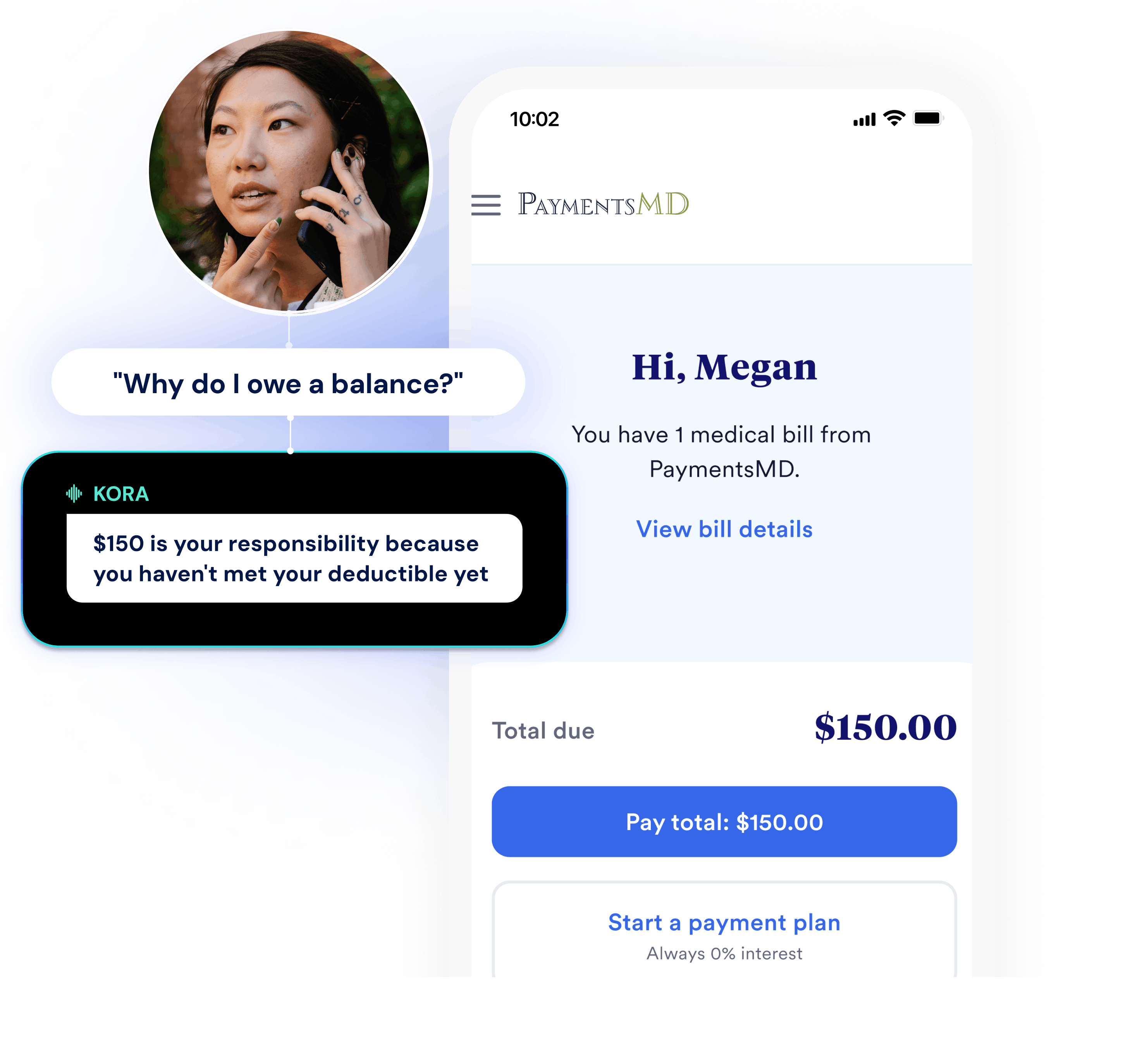

Launched in April 2025, Kora handles billing calls autonomously and escalates to a human agent when needed or requested. Unlike a chatbot that routes calls through rigid menus, Kora can manage patient inquiries from start to finish—authenticating callers, answering balance questions, explaining charges, updating insurance, and more—using both patient input and account context.

“Patients don’t really want to talk about their healthcare financial struggle,” Lizarraga says. “Kora enables them to do it in a way that feels less threatening, and we’ve been pleasantly surprised with the results.”

As of January 2026, Kora has fielded over 80,000 patient calls, reducing call handle time by 27%. That means patients get answers faster and agents are freed to assist more people. As Kora has handled more volume, ApolloMD has reduced call center staffing by 11%—all while maintaining the same high level of service.

Katnik expects the model to keep improving. “I’m excited about Kora’s ability to take on more complex calls,” she says.

What’s next for ApolloMD

The partnership continues to evolve. In addition to Cedar Pay and Cedar Support, ApolloMD is launching Cedar’s denial management solution, automating Coordination of Benefits workflows to further enhance financial performance and patient experience.

“As a clinician-owned organization, our culture is built on testing new approaches to delivering care and learning fast,” says Dr. Patel. “That philosophy has defined our partnership with Cedar from day one.”

Since 2020, ApolloMD has gone from having almost no self-pay strategy to leading the market in AI-powered patient financial experience. And they’re not waiting to see what comes next.

“Everything Cedar brings to us with AI, we are ready to trial,” says Katnik.

MORE CLIENT SUCCESS STORIES

See what Cedar can do for your practice

Cedar helps clinician services providers reduce payment friction and build patient trust—driving higher collections and satisfaction.

Book a demo1. First-year patient collection rate lift over historical baseline at ApolloMD (2021).

2. Based on a comparison between average handle time of Kora-serviced calls and non-Kora-serviced calls as of January 2026.

3. Reduction in Cedar call center staff assigned to ApolloMD since the launch of Kora in May 2025.

4. Percentage of patient collections with some evidence of digital engagement in first year at ApolloMD (2021).

5. Patient satisfaction score and number of survey respondents in first year at ApolloMD (2021).

6. Delta between 180-day patient collection rate for the best-performing discount vs. no-discount at ApolloMD; October 2024-June 2025.

7. Based on a comparison between patient collections in 2023 and 2024 at ApolloMD.

8. Average call abandonment rate in the Cedar-sevriced call center at ApolloMD; Q1 2025.