In a previous role at a North Carolina health system, Anthony Cunningham would visit local churches to share financial assistance policy updates. Not because patients couldn’t find the information themselves. It was about meeting them where they were.

“Faith was central to these communities,” Cunningham explains. “You’ve got to know who you’re caring for and what’s going to resonate with them.”

Now, as Chief Revenue Officer of LCMC Health, a $3.5 billion health system in New Orleans, Cunningham sees those community relationships becoming even more critical. The organization depends on Medicaid for about a quarter of its annual charges, making the cuts to the program in the One Big Beautiful Bill Act particularly consequential. The changes are expected to fundamentally alter how providers support their most vulnerable patients, requiring what Cunningham calls “almost like social work.”

“Folks are going to have to trust you,” he says. “You’re going to be all in their business—understanding their work schedules, their finances, their family dynamics.”

In a recent conversation with Cedar,1 Cunningham shared his analysis of how the Medicaid reforms could reshape both the finances and operations of health systems like LCMC. His insights reveal not just the scale of business impact hospitals could face, but how the changes might force a complete reimagining of patient relationships.

A perfect storm

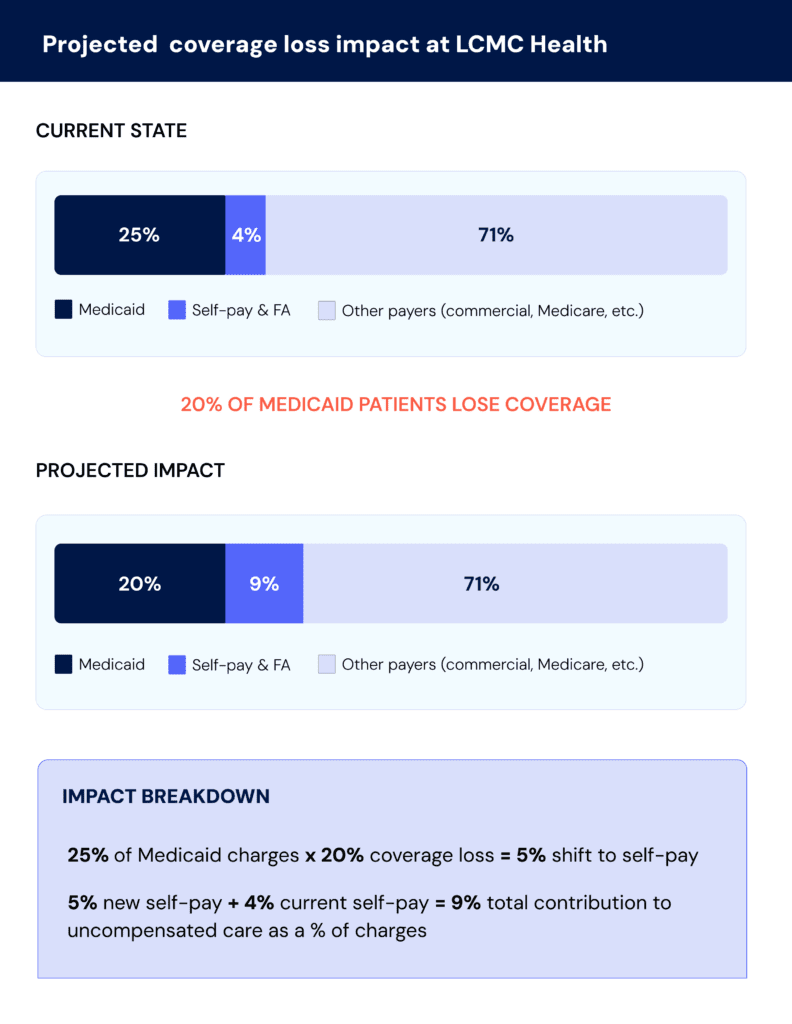

Let’s start with the numbers. Cunningham’s analysis projects that roughly 20% of LCMC’s Medicaid patients could lose coverage under the reforms. This creates significant risk to one of the health system’s main revenue sources. As Cunningham puts it: “We’d essentially be doubling the amount of services we’re providing for free.”

These projections align with broader industry analysis. The Congressional Budget Office estimates that 10 million people nationwide could be uninsured by 2034 as a result of the One Big Beautiful Bill Act.2

But Louisiana could be hit harder than most. The Kaiser Family Foundation lists it among 16 states where the uninsured rate would increase by at least three percentage points. When combined with other policy changes, some projections put that number above five.3

That’s in part because of how expansive Louisiana’s Medicaid rollout has been. When the state expanded the program in 2016, more than 500,000 adults gained coverage—one of the largest expansions relative to population in the country.4 Now, that same population faces the greatest risk from the enacted work requirements and administrative barriers.

The precedent is sobering. When Arkansas implemented similar work requirements during the first Trump administration, more than 18,000 people—about 25% of those subject to the requirement—lost coverage, largely due to missed paperwork or reporting failures.5

And the impact goes beyond coverage losses. LCMC receives supplemental payments from the state based on the number of Medicaid patients they serve. When this volume drops, those payments drop too—creating a compounding loss.

Worse, when you combine this with the reality that uninsured patients are more likely to end up in the Emergency Department, it results in a higher cost of care with less reimbursement. Cunningham describes this scenario bluntly: “It’s a perfect storm waiting to happen, and we need to get out ahead of it.”

Inside LCMC’s strategy

So the question becomes: how do you make up for those potential losses?

For LCMC, rationing services isn’t an option. The health system operates University Medical Center, a large safety-net hospital with a Level 1 Trauma Center, and must maintain comprehensive services regardless of profitability.

Instead, Cunningham recommends identifying new revenue opportunities within existing constraints—while tightening operations across the board:

1. Getting leaner on the expense side

“If you can’t grow revenue at the same rate it’s decreasing, then a key lever is reducing expenses,” Cunningham explains. That means scrutinizing everything from vendor spend to supply chain costs—the basic blocking and tackling of hospital operations but in overdrive.

“You should always be looking at your expenses year over year anyway,” Cunningham adds. “So it’s not anything new, just being really tight there.”

Hospitals are already grappling with rising supply costs, potential tariff impacts, and economic uncertainty that make this operational discipline more critical than ever. But this doesn’t have to mean cutting care quality; it’s finding efficiencies in a healthcare system where administrative costs alone approach $1 trillion annually.6

2. Ensuring maximum reimbursement

On the collections side, Cunningham sees opportunities to improve payment capture on dollars already owed.

“Patient uncollectibles are likely to increase when the Medicaid changes go into effect,” he says. “But we could offset some of that by reducing our administrative uncollectibles due to things like insurance denials.”

Negotiating better contracts with commercial insurers is another option. And now, Cunningham says, the story health systems like LCMC can tell is more compelling:

“We’re in the business of taking care of the people of New Orleans,” he explains. “In order for us to continue to do that, we have to look at our reimbursements across all these different services.”

That strategy includes benchmarking the health system against peers and using its essential community role to push for rates that better reflect the value it provides.

3. Reimagining financial counseling

Perhaps the most impactful shift would involve overhauling how patients are screened for and get connected to financial assistance.

Like many health systems, LCMC currently outsources enrollment support and uses presumptive eligibility on the backend. But with self-pay and financial assistance cases potentially doubling, that approach becomes unsustainable.

“We need to get really creative and understand what additional funding sources are out there,” Cunningham says. “How might we do a better job of helping our patients navigate through the system?”

His vision is comprehensive: start with financial assistance screening—ideally before care—then move systematically through Medicaid eligibility, foundation programs, ACA plans, medication assistance, and patient financing options.

“If you can do that using technology without staff intervention,” he adds, “even better.”

Building patient stickiness

The real transformation, though, goes deeper. Cunningham sees the Medicaid changes as an opportunity to build what he calls “patient stickiness”—tighter relationships that keep patients within LCMC’s four walls.

“Patients will need to trust us to help them navigate the process and stay enrolled in Medicaid,” he explains.

The challenge is scale. Helping patients through work requirements, more frequent eligibility checks, and multiple funding sources could quickly overwhelm traditional staffing models.

But as Cunningham astutely points out: “Most people have cell phones these days.” The answer, he suggests, may lie in helping patients manage their coverage digitally, without relying on manual support for every step.

He imagines a comprehensive system that follows patients throughout their healthcare financial journey—eliminating the need to restart paperwork and reverify documentation at each encounter. “You don’t want them bouncing to various hospitals because they have to do the process over and over again,” he says.

The goal is consistency, trust, and accessibility, whether patients are in the Emergency Department or at home.

It’s a return to the community-centered approach that brought Cunningham into those North Carolina churches—but scaled for a far more complex challenge. In this moment of policy whiplash and fiscal uncertainty, the hospitals that succeed will be those that don’t just adapt, but reimagine their role in patients’ lives.

“We have to figure out how to foster better relationships with our patients,” he says. “Because patient compliance is going to be the key to all of this.”

Want to dig deeper? Our executive brief breaks down Medicaid reforms in the One Big Beautiful Bill Act—including a blueprint for building a digital safety net.

This article presents insights from an interview conducted by Cedar. The analysis and projections discussed represent the interviewee’s professional perspective and do not reflect Cedar’s views or recommendations.

Joanna Jamar is Sr. Director of Commercial Strategy at Cedar

- Cedar. (2025, June). LCMC Health analysis, projections, and response strategy based on a conversation with Anthony Cunningham, Chief Revenue Office of LCMC Health.

↩︎ - Congressional Budget Office. (2025, July 8). Estimated budgetary effects of Public Law 119-21, to provide for reconciliation pursuant to Title II of H. Con. Res. 14, relative to CBO’s January 2025 baseline. https://www.cbo.gov/publication/61570 ↩︎

- Kaiser Family Foundation. (2025). How will the 2025 reconciliation bill affect the uninsured rate in each state? Allocating CBO’s estimates of coverage loss. KFF. https://www.kff.org/affordable-care-act/issue-brief/how-will-the-2025-reconciliation-bill-affect-the-uninsured-rate-in-each-state-allocating-cbos-estimates-of-coverage-loss/ ↩︎

- Health Resources and Services Administration. (n.d.). Maternal and Child Health Bureau data. U.S. Department of Health and Human Services. https://mchb.tvisdata.hrsa.gov/Narratives/Overview/64d9c860-8fb9-48b2-a6c5-441b0aa1a1c2 ↩︎

- Grantmakers in Health. (2025). Issue focus: Overview of potential Medicaid changes in 2025 budget reconciliation bill. https://www.gih.org/publication/issue-focus-overview-of-potential-medicaid-changes-in-2025-budget-reconciliation-bill/ ↩︎

- Sahni, N. R., Gupta, P., Peterson, M., & Cutler, D. M. (2023). Active steps to reduce administrative spending associated with financial transactions in US health care. Health Affairs Scholar, 1(5), qxad053. https://doi.org/10.1093/haschl/qxad053 ↩︎