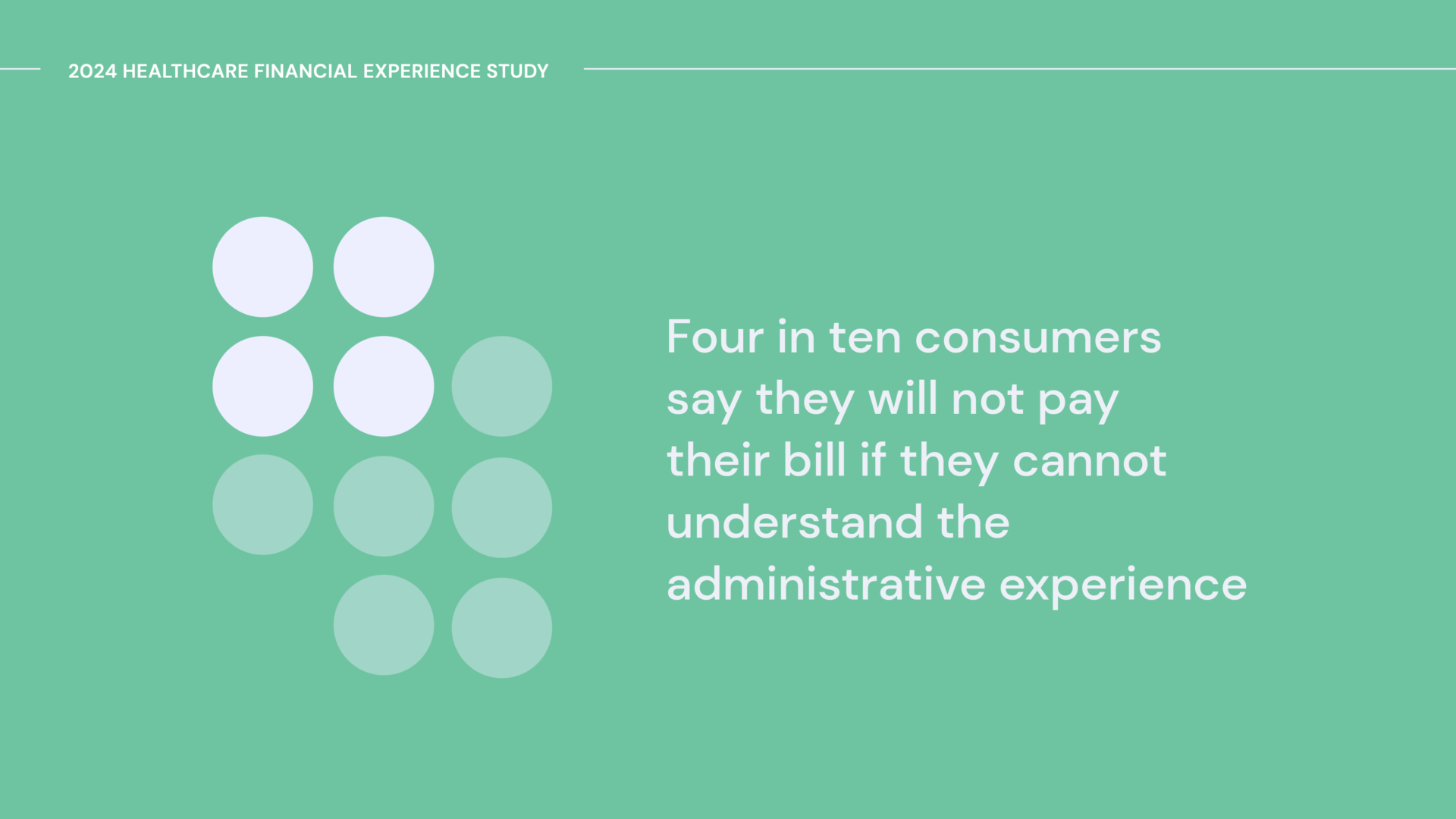

When thinking about all of the issues that surround the patient financial experience—confusion, administrative waste, overpayments, etc.—it’s impossible to point to just one cause. Why? Because the healthcare financial ecosystem is made up of multiple parties, all of whom play an important, yet currently disconnected, role.

To better understand the disconnect, we surveyed consumers about their biggest pain points. And not surprisingly, more than half (58%) told us that reconciling a billing issue with their healthcare provider and health insurer is, in a word, stressful. Certainly not an ideal experience while dealing with a medical issue.

But payer and provider misalignment isn’t just stress-inducing—it can also have serious financial ramifications for all parties.

Payers and providers: Here’s what we learned.

69% wait to pay bills from their healthcare provider until their health insurer indicates they are done processing a claim (e.g., sending an Explanation of Benefits document).

Why this matters: If consumers aren’t confident that their insurance benefits are correctly applied to a claim, it’s reasonable that they’ll want to wait to make a payment—and these delays can impact bill resolution. Health systems are experiencing some of the worst margins since the pandemic started, and can’t afford to have their patients be confused. When provider billing and payer data are in sync, consumers can feel confident that their balance is correct, and pay in a timely manner.

More than one-third (36%) of consumers in our survey were sent to bad debt collections because of a billing issue between their healthcare provider and health insurer.

Why this matters: Getting sent to collections can have a devastating impact on a consumer’s credit, which can have a ripple effect across other aspects of their life (buying a home, leasing a car, etc.). Traditional collections practices are not an effective way to help consumers resolve their bills; they are more likely to negatively impact your organization’s reputation. Healthcare consumers today have more options than ever, so maintaining a strong brand reputation is essential to retaining patients.

28% find it difficult to access real-time information about their healthcare benefits when paying their healthcare bills.

Why this matters: While healthcare costs are still behind inflation rates, consumers are feeling the impact of rising prices on their wallet—and should have the ability to effectively budget for, and plan for, care. Without a clear understanding of their healthcare benefits, such as progress hitting their deductible, HSA balance, etc., consumers are at risk of leaving money on the table, missing opportunities to save on costs.

The Bottom Line

Having to interact with multiple, disconnected parties about different financial aspects of a single healthcare encounter leads to a bad experience, lack of clarity and poor financial outcomes, putting a finer point on the need for healthcare providers and payers to work together to prioritize the interests of consumers.

That’s why we’ve invested in bringing real-time insurance data into our Cedar Pay platform with our Payer Intelligence Layer—learn more here.